| T.03 Pending | T.03 Plus Pending | 6S Pending |

|

|

|

|

TradeCraft Updated Feb. 09 |

S&P | CRUDE | GOLD

|

Early Birds and the Forex Journal-Currencies for Q3&4 2013 Learned tomes of which Forex Journal is an undoubted leader provide many functions. The best educate, teach, enliven and inform. These are processes of reward and enrichment of the brain, spirit and soul. In some cases that enrichment can even go straight to your pocket, a much underestimated part of the metaphysical anatomy which, for traders is closely aligned with the heart. All of you know the joy and sense of wellbeing that a great trade brings. Happiness, delight; for some sheer relief. All emotions that boost health, self-esteem and of course wealth, and likely lower your cholesterol and blood pressure as well, conditions much ignored by our younger readers but nonetheless pervasive killers stalking the unwary. The very best antidote to the slings and arrows of outrageous fortune which beset our everyday lives and traders' lives in particular, are well plotted, superbly executed and highly valuable winning trades. This is a story of one such adventure. It starts in December 2012 when the publisher of this august magazine wrote to ask me to opine on the best currency trades of 2013, a great pipe opener for the year and if analysed correctly, a boon for currency traders looking to start the year with a flourish. For me, a dweller in the lands Down Under (Australia and New Zealand), this was a no brainer as I live every day with the tyranny of the most overvalued currencies on the planet, the Aussie and Kiwi Dollars (AUD and NZD). Thus, in the fullness of time, my article "The Words that Dare Not be Spoke Down Under!-The Best Currency Trades for 2013" appeared in the February edition of Forex Journal, where I told you that the best trade of 2013 was going to be short the AUD against all of its major trading partners USD, EUR and JPY. I didn't fail to show you that the Aussie and Kiwi currencies are joined at the hip due to Australia's position as New Zealand's major trading partner and the trading band that CER (Closer Economic Relations) legislation and usage imposes. Hence, you were armed at the start of the year with a bag full of options. Two currencies whose fundamentals were systemically at risk and several different possible strategies. Property values, Treasury tax receipts and Stock Markets are just the flag bearers of important socio-economic functions that are merrily reported by local news media without regard to the reality of currencies at the cross rates, but ignorance of how currencies link all aspects of your life is injurious to your financial health as we shall briefly examine. To bring you up to date, I said in my previous article that the week around February 14 would be an important inflection point for AUD, but I reckoned without Mr Abe's ambitious "3 Arrows" plan to break Japan from its endless deflationary cycle. This from a speech he gave on 02/22/13: "As the first arrow, I urged the Bank of Japan to do their job, on a

dimension they thought they couldn't do. Investors, both Japanese and foreign,

have started to buy Japanese shares. Japan's industrial wheels are better

greased due to export growth, and Tokyo's stock index has risen as a result. The

second arrow is to carry out a supplementary budget, huge enough to lift the

economy by 2 per cent and create 600,000 jobs. The third one is about growth

strategy. Private consumption and investment will come much sooner than we

expected. So far, all the economic indicators point north." This ambitious and unprecedented stimulus sent JPY ballistic on the cross rates and nowhere more obviously than in AUD-JPY. Mrs Watanabe, the mythical Japanese housewife investor has been a mainstay of Australian capital raising for decades, as she arbitraged the traditionally high interest rates on offer from a generous Australian Treasury against the ZIRP options so long prevalent in her homeland. The euphoria caused by this announcement sent AUD-JPY into orbit as with the exchange risk hopefully neutralised, this on-going favourite for the carry trade appeared to become an even stronger one way bet. As usual, the market had well anticipated this policy. Here's the chart:

There are three points of interest on this chart which

you may not be familiar with. The chart is a 12 day timing chart. Our base

timing chart is a 6 trading day chart, that is each bar is composed of 6

trading days or in this case 12 trading days. The timing cycles along the top

of the chart are the dominant Danielcode 59 cycle which traditionally marks

tops and its next iteration 2X59. Running from the high of the rally at 11/2007

we get exactly 2 periods of the 59 cycle expiring in the 12 day period ending 04/08/13,

and that gave us the closing high for the move. All chart analysis is valid

from bar high/lows and also from closing highs and lows. Hence the DC time

analysis is often variable by +/- 1 bar period. The red line drawn on the chart is the 4th

Degree line. Price or the vertical axis of charts is the 1st Degree;

Time or the horizontal axis of charts is the 2nd Degree; Volume is

the 3rd Degree and the 4th Degree is an angle combining

time and price. There are many angles applicable to charts. Some provide simple

support and resistance, others project future trading channels. All are useful.

But the most useful of all are the 4th Degree lines which have a set

of formal rules for their construction. In many respects they act as support

and resistance but have the peculiar and valuable additional quality that we

expect to see price meet the 4th Degree line at major DC time

cycles. When this conjunction of time and price occurs we say that "Time and

Price are Squared", and when time and price are squared a turn in market

direction is almost inevitable. Gnostics ("those who know" from the Latin Gnostici)

call this conjunction The 4th Seal. It is one of the miracles of the

Danielcode. Whilst the 4th Degree adopts a lateral view

of charts in that it combines time and price with its angles and time cycles,

we must not fail to apply our simple linear analysis. The Danielcode uses a

series of proprietary ratios unlike any others you have seen, although 2 of the

7 DC ratios are close to the more traditional fibonnaci ratios, but don't

confuse them. The DC ratios spring from a wholly different mathematical

paradigm. Potent amonst these ratios is the now famous Danielcode Black line at

89%, the last level of support or resistance for the operating swing on all

charts. Markets are notorious time shifters and what is not apparent on one

time series may be a shining light on another. Our rules of analysis require

that we consider 6, 12 and 24 day charts and adding our DC ratios to the 24 day

chart, this time a close only chart shows that not even the most ambitious

fiscal intervention could overcome this mark:

Thus in early April 2013 we had strong evidence from the 4th Seal, DC time cycles and the DC retracement tool to expect at least a meaningful correction in this currency pair, the most important driver of the ubiquitous Yen carry trade. It's now down over 14% from the recent high. Carry trades have two elements of risk and reward. The exchange rate at time of maturity and the interest differential. The latter is a function of government policy and as a consistent borrower of overseas capital Australia has run official interest rates 3-4 points above its major trading partners, US, Japan and Europe. Not coincidentally these are also its major lenders. As Down Under manufacturers and other export businesses other than mining have suffered under the ravages of the high Aussie and Kiwi Dollars, including Ford Australia shuttering its 85 year old car making business in Victoria, few have publicly argued that this AUD strength is a direct result of government and Reserve Bank policy. Apparently the needs of government to fund its always expanding political largess trumps all other considerations. The Melbourne Age newspaper provides a concise summary of the Aussie Dollar's imminent demise: ..the high dollar has made Australian producers

dramatically less competitive in global and domestic markets. The International

Monetary Fund estimates that it costs 55 per cent more to produce goods and

services here than it does in the US. The miracle is not that manufacturers

such as Ford are pulling out, but that so many have found ways to survive. But,

once they go, they won't return. The overvaluation of the dollar is temporary,

but it changes the economy permanently. The mining boom has peaked, and is now declining. The

greatest risk we face is that the weakening economy will fail to develop the

momentum to leap the gap left by declining mining investment. If we fail, it

won't be because interest rates are too high, but because the dollar is too

high. To cut to the chase, the Reserve faces the choice between risking

recession or risking inflation. One way or another, by policy choice or market pressure,

the dollar is going to fall a lot ahead, as mining investment subsides, and -

you hope - the global economy finally gets its mojo back. That will make our

producers competitive again; it's what we want to happen. But it will have

unpleasant side-effects. A lot of things we now take for granted will become

more expensive, maybe much more expensive. The holiday in Europe we were

planning could cost 20 per cent more, and become unaffordable. Petrol will be

much more expensive. So will all the imports we buy: cars, computers, mobile

phones, household goods, food and clothes. Until now, the high dollar has made the Reserve Bank's

job easy by making imported goods cheaper. When the dollar falls, they will

become more expensive, and inflation could rise well above the Reserve's target

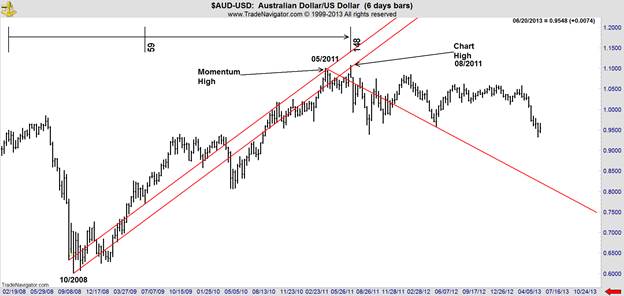

zone of 2 to 3 per cent. So to return to the theme of this article, let's look at where the AUD-USD pair is now and what the future has in store with our 6 day timing chart:

Again our dominant 59 DC time cycle called the top near 08/2011. This was the 2nd iteration of this time cycle, valid as our rules say "it shall be for time, times and an half", and the twice 59 cycle gave us the chart high at the spike in the 6 day period ended 08/2011. Looking at our 4th Degree angles we have on the above chart 2 rising angles, one emanating from the 10/2008 low and the other from the low before the low. The latter line gave us the momentum high near 05/11 whilst the former gave us the chart high 3 months later. If you noted that the high projected by the upper of the two near parallel lines gave us the momentum (closing) high but then a benign 7 week counter trend whilst the lower red line drawn from the 10/28 low gave us a significant trend change, then you are on to the difference between a 4th Degree line and the 4th Seal. The conjunction of the 4th Degree line with an expiring DC time cycle is what made a trend change after 08/2011 almost inevitable. Another way of looking at charts in the lateral plane is by using DC trading channels. These are basically regression channels using the DC ratios. For transparency and the benefit of those interested in market timing, you can read how, in the two "Master Class" articles at my website www.thedanielcode.com and there are detailed videos there also on constructing and reading DC trading channels. Let's start with the major time frame and work back to complete our analysis of where this currency pair is headed. As the short AUD and NZD theme has worked so well for us in the first half of the year, I suggest we stick with it in the latter half as both of these currencies have much further to go on their corrective path

There are two valid DC trading channels on the above

chart. The channel in blue is the long term trading channel running from 2001

whilst the red channel starts in 11/2008. Note that this market has found

support at the 1SD of the blue channel and the 2SD of the red channel and the

DC retracement at 92.92. This is neither a miraculous occurrence nor

happenstance. This is what markets do all of the time. From this strong support

we expect a rally before AUD-USD resumes its downward path. It has a date with

destiny at the 2SD of the blue DC trading channel near 86.56 by November this

year. Here's the current move on the daily chart bottoming

for now at the "heathen" 70 cycle which we more traditionally associate with

Euro time cycles, and at 3SD from its DC mean. There is still much to play for on the short side.

Spend a moment reflecting on what the present 14%

decline in the Aussie means in this country where private debt ranks near the

highest in the world and where housing prices are also world leaders. And

consider the words of Reserve Bank Governor Glen Stevens for context: "Central

banks can provide liquidity to shore up financial stability and they can buy

time for borrowers to adjust, but they cannot, in the end, put government

finances on a sustainable course. They cannot shield people from the

implications of having mis-assessed their own lifetime budget constraints and

therefore having consumed too much." Glen Stevens, Governor of the Reserve

Bank of Australia" Things are getting interesting!!

John Needham Sydney Australia 19 June 2013 "The fox knows many things, but the hedgehog knows one big thing. A Hedgehog Concept is not a goal, intention or strategy to be the best. It is an understanding of what you can be best at. The distinction is absolutely crucial". ~ Isaiah Berlin, The Hedgehog and the Fox |

Disclaimer: All the reports, charts and content in the Danielcode web site are for educational purposes only and do not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author only and should be treated as such. Before acting on any of the ideas expressed, the reader should seek professional advice from a licensed broker in the appropriate jurisdiction.

Risk Disclosure for Front Page, Long Term Trend Charts: THE RISK OF LOSS TRADING COMMODITIES OR FUTURES CAN BE SUBSTANTIAL. COMMODITY TRADING HAS LARGE POTENTIAL RISKS, IN ADDITION TO ANY POTENTIAL REWARDS. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THE FUTURES OR COMMODITIES MARKETS. DON'T TRADE WITH MONEY YOU CAN'T AFFORD TO LOSE. THIS IS NEITHER A SOLICITATION NOR AN OFFER TO BUY OR SELL COMMODITY INTERESTS. THE USE OR PLACEMENT OF ANY STOP-LOSS OR STOP-LIMIT ORDERS MAY NOT LIMIT YOUR LOSSES AND YOU COULD LOSE MORE THAN YOUR INTENDED AMOUNT OF MONEY AT RISK. PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT INDICATIVE OF FUTURE RESULTS.

Risk Disclosure for Genie Results, T.03, T.03+ and TradeProgram: HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.