The Greatest Story Never Told

Random Walk Theory, one of the most widely known and

accepted tenets of financial knowledge, postulates that changes in asset prices

are random. The outcome is that stock prices move unpredictably so that past

prices cannot be used to predict future prices accurately. This theory

challenges the idea that traders can time the market or use technical analysis

to identify and profit from patterns or trends in stock prices. However, the

slavish adherence to price and the myriad of studies Random Walk Theory

supports as the basis of market analysis have done traders a great disservice.

From learn-to-trade through portfolio creation and management, superannuation,

savings, and wealth accounts, this is a multi-billion-dollar industry. An

understanding of when and where markets move is the foundation of trading

knowledge. If one seeks a better understanding of why markets do what they do,

there is another way, and I want to introduce you to something completely

different – The Other Way – Danielcode Time.

Every bar on every chart has elements of both Time and

Price, yet strangely, no weight is given to the effects of Time on charts of

various periods. Random Walk has suppressed that, but as every trial lawyer

knows, an answer is largely a function of the question asked. If we add the

element of Time, a different pattern emerges. By Time, I mean the normal

periodic cycles that impact our daily lives.

At the

Danielcode (DC), we start with a unique group of Time ratios from a historical

document, a statement of just fifteen lines that gives us the rule of eighths

and a sequence of Time cycles. Before April 9, 2001, when the

Securities and Exchange Commission ordered all U.S. stock markets to switch to

the decimal system, prices were reported, and stocks were denominated, in

fractions – in one-sixteenths to be

exact. One-sixteenth is half of one-eighth and was

the basis of all stock market quotes before decimalization. This

approach is still in use in the old Board of Trade markets, such as grains,

which uses two-eighths or one-quarter, and US T-Bonds, which uses a tick value

of thirty-two or four-eighths. Applying basic math to the numbers in this historic

text creates a base number for Time of 29.66 days and a known progression from

there. As all historic sources must be questioned, this particular group of

numbers not only gives us 29.66 days as Time, a number almost identical to the

length of a synodic (average) month at 29.53 days with a variance of just three

hours per month, but also a value of 365.37 days which is the length of a

calendar year accurate to about two hours a year. The ability to compare our

calculated Time cycles to known cycles gives us confidence in the veracity of

these calculations. To stress the testing, we will use index and futures

charts on our journey of discovery.

As fully 30% of daily bars do not appear on any

trading charts due to weekends and market holidays, one assumes that we should

encounter a standard error of that percentage in our calculations. However, as

I will show you, such is not the case; due to this vagary, Time and Price bars

are subject to some small dilution of accuracy. As such, we can safely discard

the numbers after the decimal point in our discussions of Time. This means that

if you do not like the historical document argument, you can adopt the length

of a synodic month as your base of Time, which is perfectly acceptable, as they

are effectively the same thing.

Danielcode Time cycles are like nothing seen before.

They are a novel concept, based on a mathematical derivative of Daniel’s Code,

a historical dissertation on Time and how it progresses as “Time, Times and a

half,” or put more simply: Time repeats, doubles, and halves. The basic number

for Time in the Danielcode lexicon is 29.66 days and it expands by halves, so

that the following number in the sequence is 44.46, then 59.32, and so on.

29.63 days is a close fit, with 29.5 the length of a synodic (average) month.

Monday,

October 19, 1987, was by far the worst day in Wall Street history

when the market fell 22.6 percent – almost twice as bad as the worst day of

1929. Black Monday passed into history, but it is not forgotten as markets have

a long and extraordinary memory. In fact, Black Monday starts a number of Time

cycles that are enduring today. At the Danielcode, we maintain that 6.21 days

is the fundamental vibration of all markets, and accordingly, we use

6-day,12-day, and 24-day charts for our Time analysis and daily charts. For our

exposé on the magic of Time, we use the S&P 500 in both its index and

futures form, which are the broadest and most widely accepted measure of the ups and

downs of equities.

The use of Time cycles clarifies our concept of how

markets work when looking at long term charts. This can be further drilled down

to daily bars, which independently create their own buy and sell signals. Add

an understanding of Time as Price (no, that is not a typo) and the path to

understanding why markets do what they do, and how they work hard to make your

trading profitable, will come into view. Now, I know from much experience that

the vast majority of you want only to see the give me the money moment,

and that is coming, but the journey must, of necessity, take you to the

questions: Does any of this work? And how much of Time cycles is astrology,

fairy tales and the much-vaunted Mars Retrograde or other esoterica? The answer

is none of it; at least, not here at the Danielcode. Here, we are

long-term sceptics, and as an Attorney of many years standing, I maintain that

every statement or proposition must be supported by better than the civic

standard of “on the balance of probabilities”, and instead be approaching the

normal criminal proof of “beyond reasonable doubt.” That is a high bar but let

me show you the road to market knowledge and a significantly boosted profit

line.

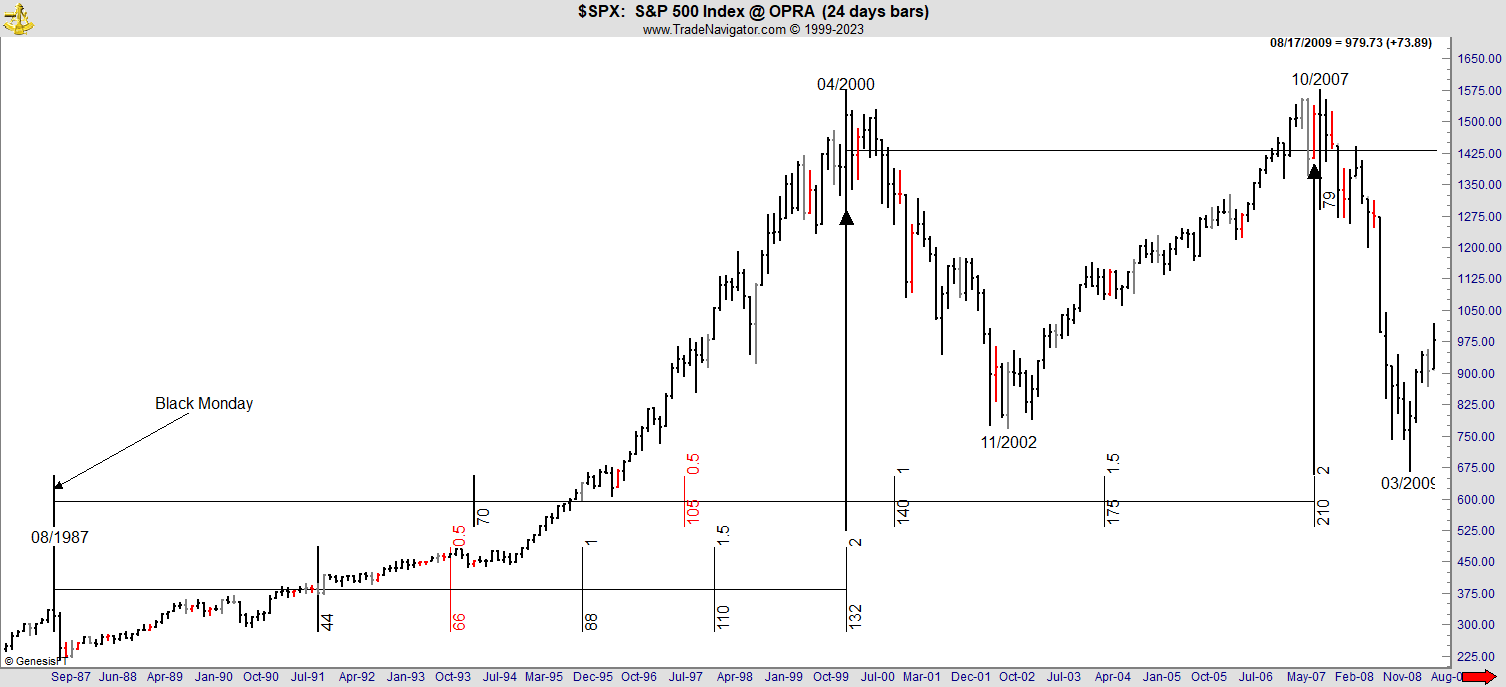

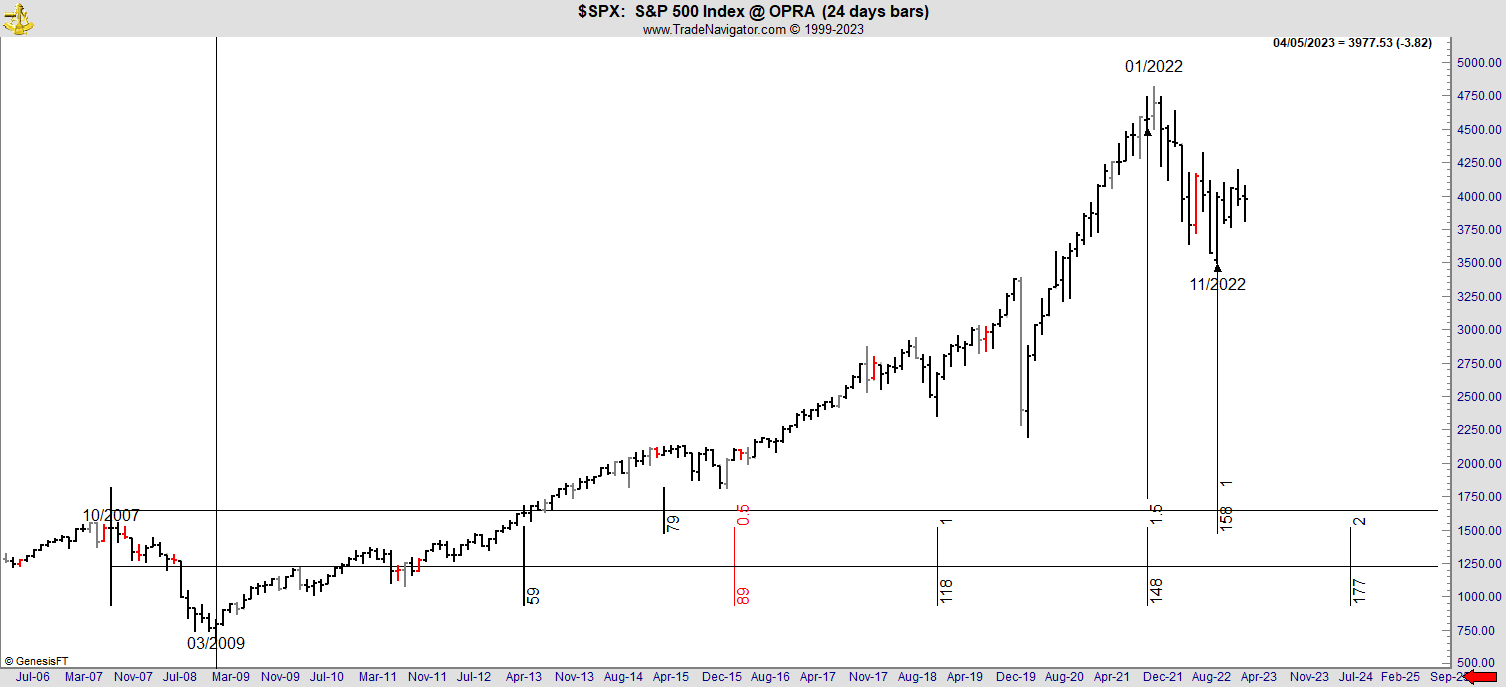

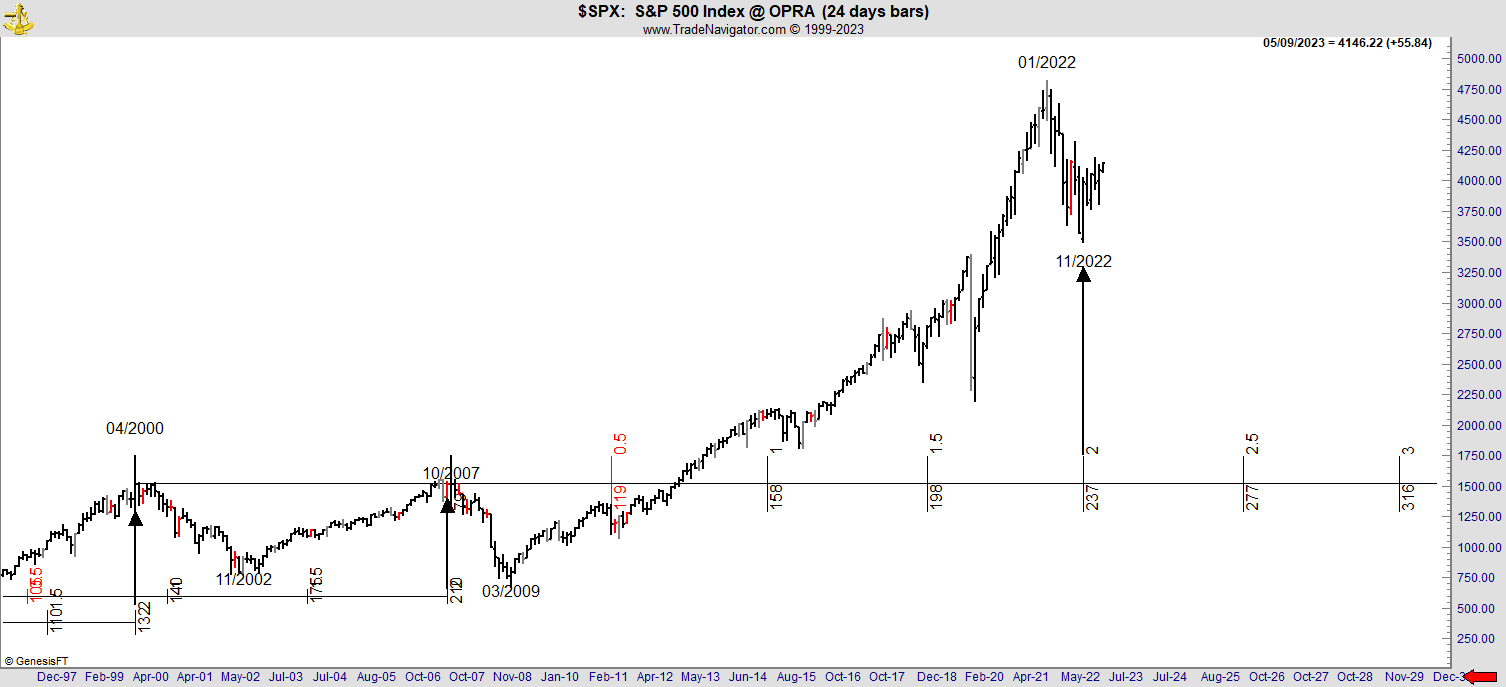

The 24-Day Long-Term Charts

Beginning on Black Monday, October 19, 1987, we start

with our long-term chart, which has 24 days to every bar. This allows us to

examine more data, and the impact of expiring Time cycles is pronounced on

these charts. From the swing high of 1987, the market ran two cycles of 44 into

the Dot.Com high of 2000 and two cycles of 70 into the closing high immediately

before the 2007 swing high on the Index. As both 44 and 70 form part of the

matrix, which we derived with some basic math from Daniel’s Code, this

immediately piqued my interest.

This is the S&P 500

Index on a 24-day chart.

What I am about to show you is not new; I have been talking and writing

about the marvels and mysteries of Daniel’s Code since about 2000.

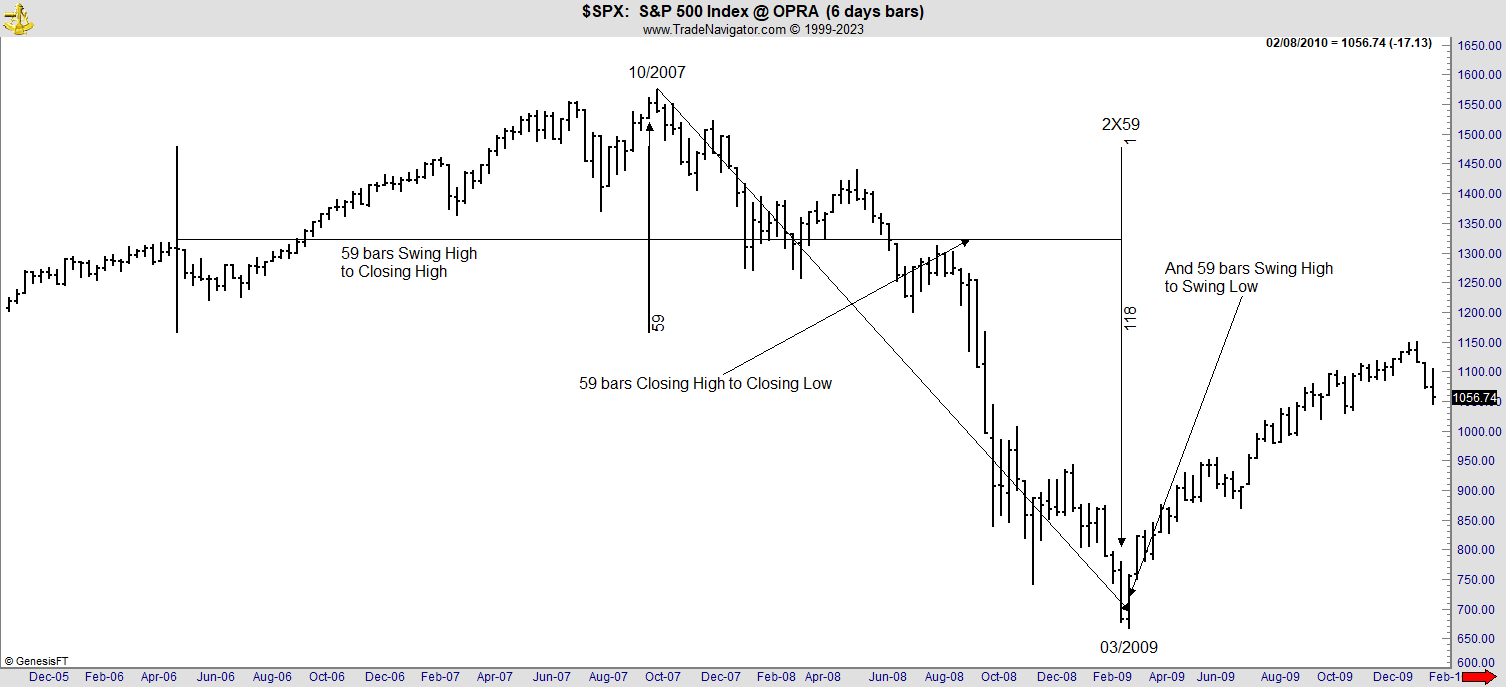

In 2008 I noticed that on its 6-day chart (see

overleaf), the S&P ran a 59 period Time cycle into its 2007 top. So, we

watched to see it repeat into its 2009 low. As stated, nothing here is new or

gained with hindsight. I wrote an article about the 2009 low, which West Coast

wealth manager Financial Sense published on May 15, 2009, called 666 The

Number of The Beast. This article is available under the Articles tab on

the Danielcode (DC) website and shows you the origin of the 59 Time cycle, how

it timed the 2009 low to the day, and just a few ticks in Price.

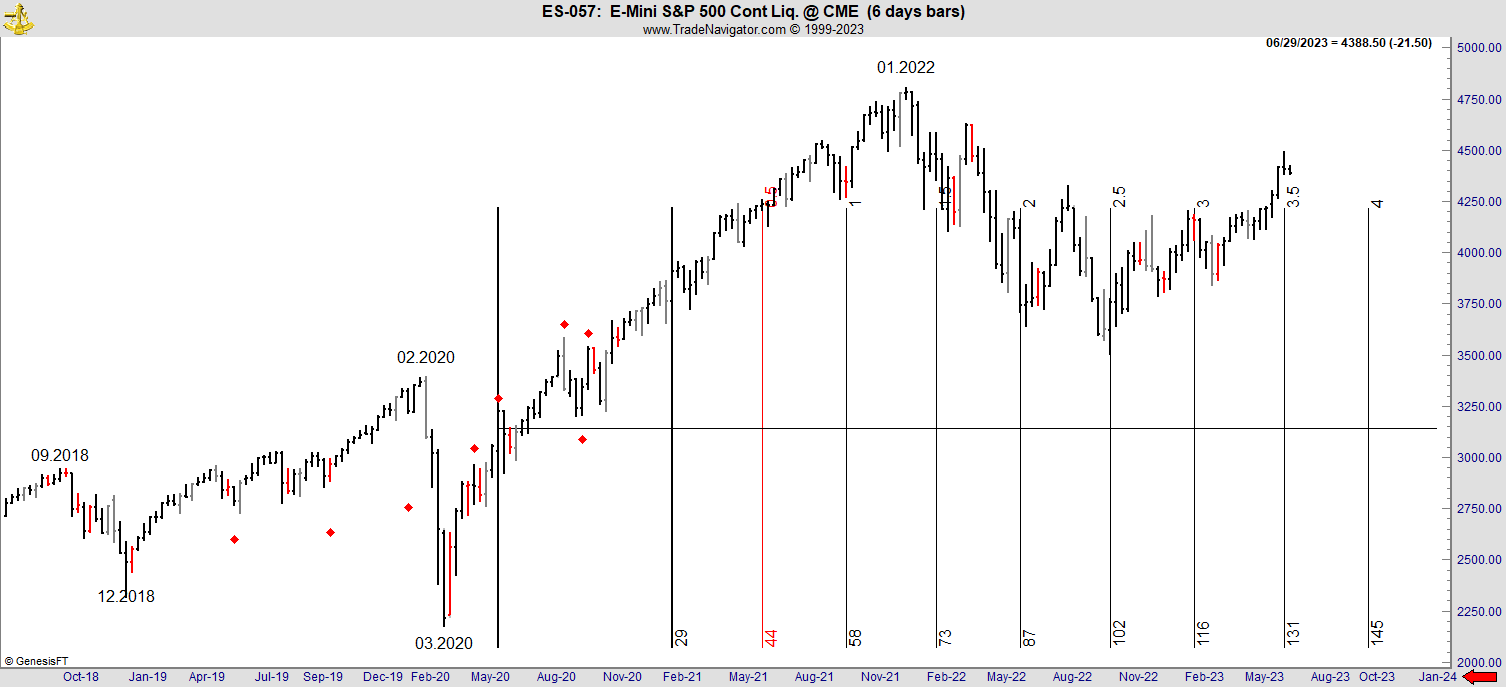

The following chart is the 6 day chart of the S&P

500 index where every bar is created from 6 trading days. The Time cycles

reveal themselves on both the Futures chart and the Index, with views being

more visible on one or the other. For our purposes, both are valid, and we

switch between them to promote clarity.

Watch this 6-day chart of the Index closely. The

legendary WD Gann used to say, “If you are worthy, I will tell you the number,”

and to those he deemed worthy, he would tell them that the vibration of all

markets was 7, which is wrong. The minor vibration of all markets is 6.21. Note

in particular the symmetry of closing high to closing low and chart high to

chart low as the 59 Danielcode Time cycle repeats, and repeating is the highest

probability for all time cycles.

This

is the S&P 500 Index on a 6-day chart.

From here, you see the dominance of the 59 cycle

through 2006-2009. Nothing about time cycles is crude or obvious. It is always

subtle and resembles a whodunnit as clues link together. While the old

saying “…markets do not repeat, but they rhyme…” came from a wise man,

he was not a Futures or Forex player where repetition is sometimes a large part

of the game. However, the demand for nuance sometimes shows itself as a shift

in the structure of the time charts.

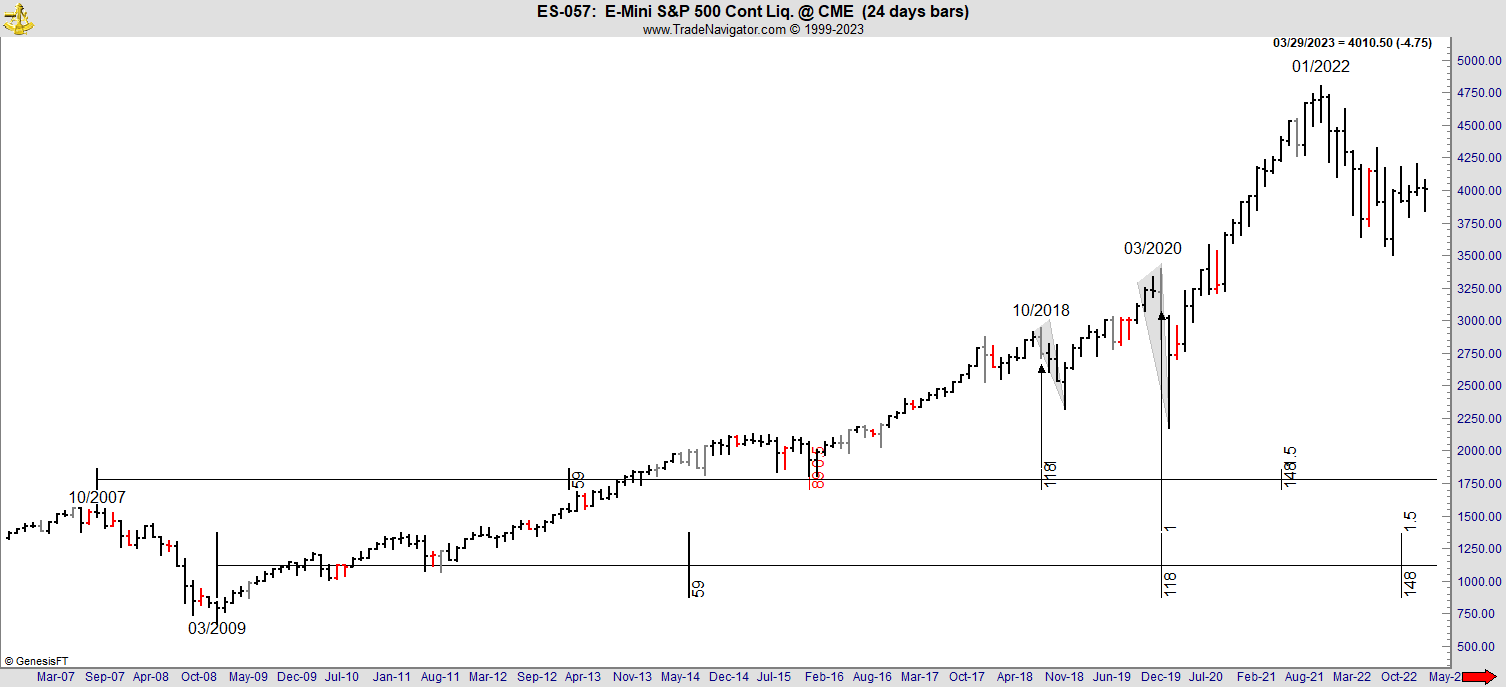

From the 2009 low, the dominant 59 cycle prevails, but

it shifts back to another of our Danielcode Time cycle charts, the very

long-term 24 (4×6) day chart,

where every bar comprises 24 trading days. Regarding trading days, bear in mind

that we lose 104 days to weekends and more to public holidays, so generally,

there are 252 trading days in a year. Still, we are taking 365 days or 360

degrees of Time and squeezing it into the available trading days, which are

just 69% of calendar time. The amazing thing is that these time cycles work at

all, and that they do so with such precision is another of the great wonders of

Futures and Forex. I should say here this is not market timing, as stock

traders understand it. This is something else entirely.

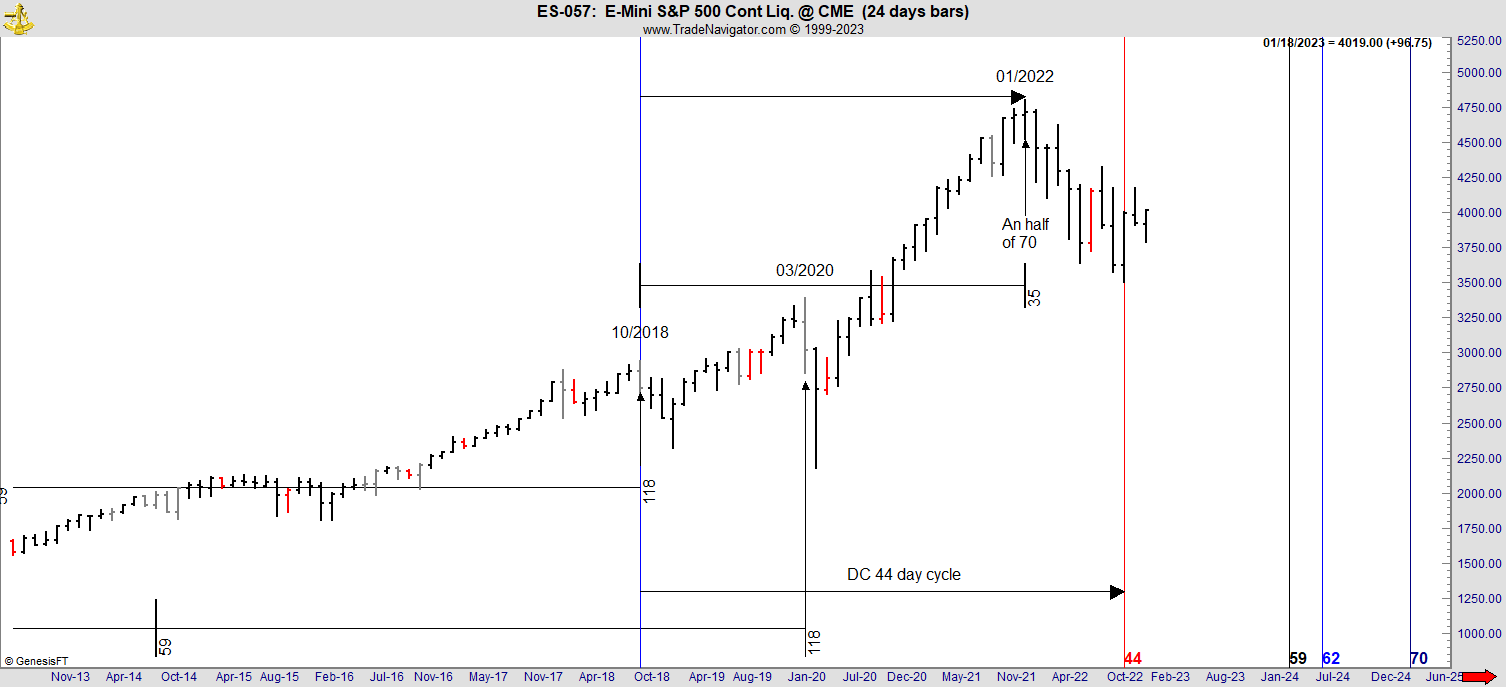

This is the

S&P 500 Emini Futures contract on a 24-day chart.

From the chart above, we see

the quite unexpected and entirely unique recognition of the highs of the

October 2018 and the COVID flash crash high of March 2020. Of interest is how

the dual fifty-nine cycles from the 2007 high and the 2009 low both pointed to

significant breaks in the long bull market up to January 2022. The corrections

that followed from October 18 and March 20 are the

largest corrections since the 2009 low and prior to the current pullback. The

03/20 correction was the famous COVID-19 flash crash which triggered the

shortest bear market in history. Surely you cannot think the identification of

these two highly significant turns was happenstance?

From the chart above, we see

the quite unexpected and entirely unique recognition of the highs of the

October 2018 and the COVID flash crash high of March 2020. Of interest is how

the dual fifty-nine cycles from the 2007 high and the 2009 low both pointed to

significant breaks in the long bull market up to January 2022. The corrections

that followed from October 18 and March 20 are the

largest corrections since the 2009 low and prior to the current pullback. The

03/20 correction was the famous COVID-19 flash crash which triggered the

shortest bear market in history. Surely you cannot think the identification of

these two highly significant turns was happenstance?

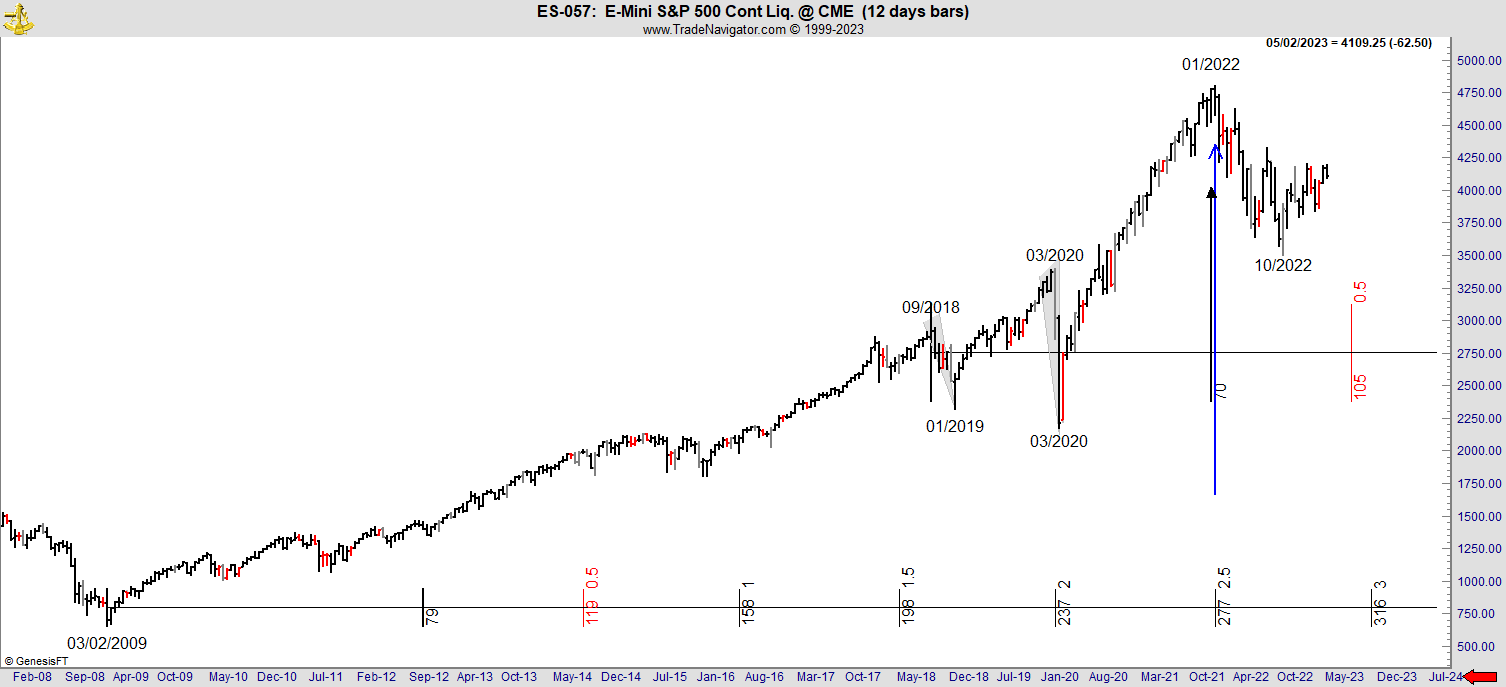

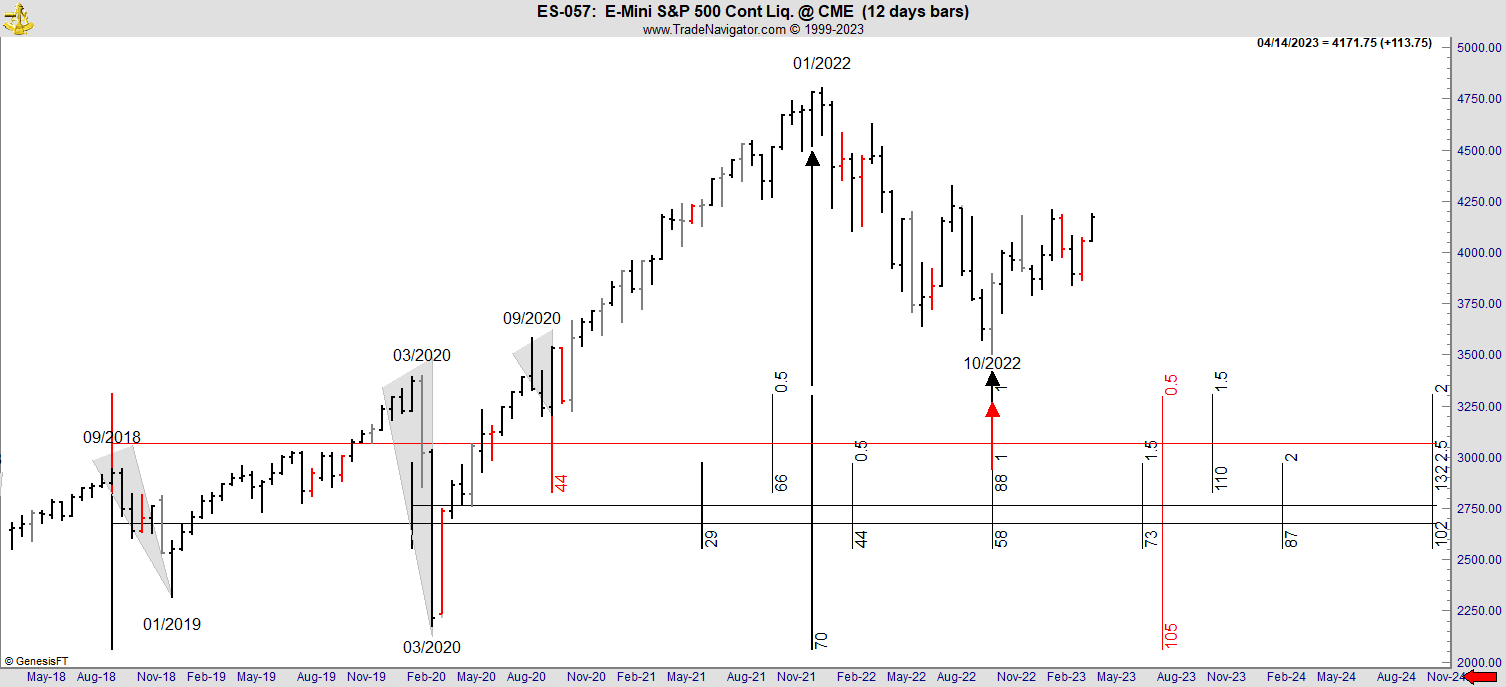

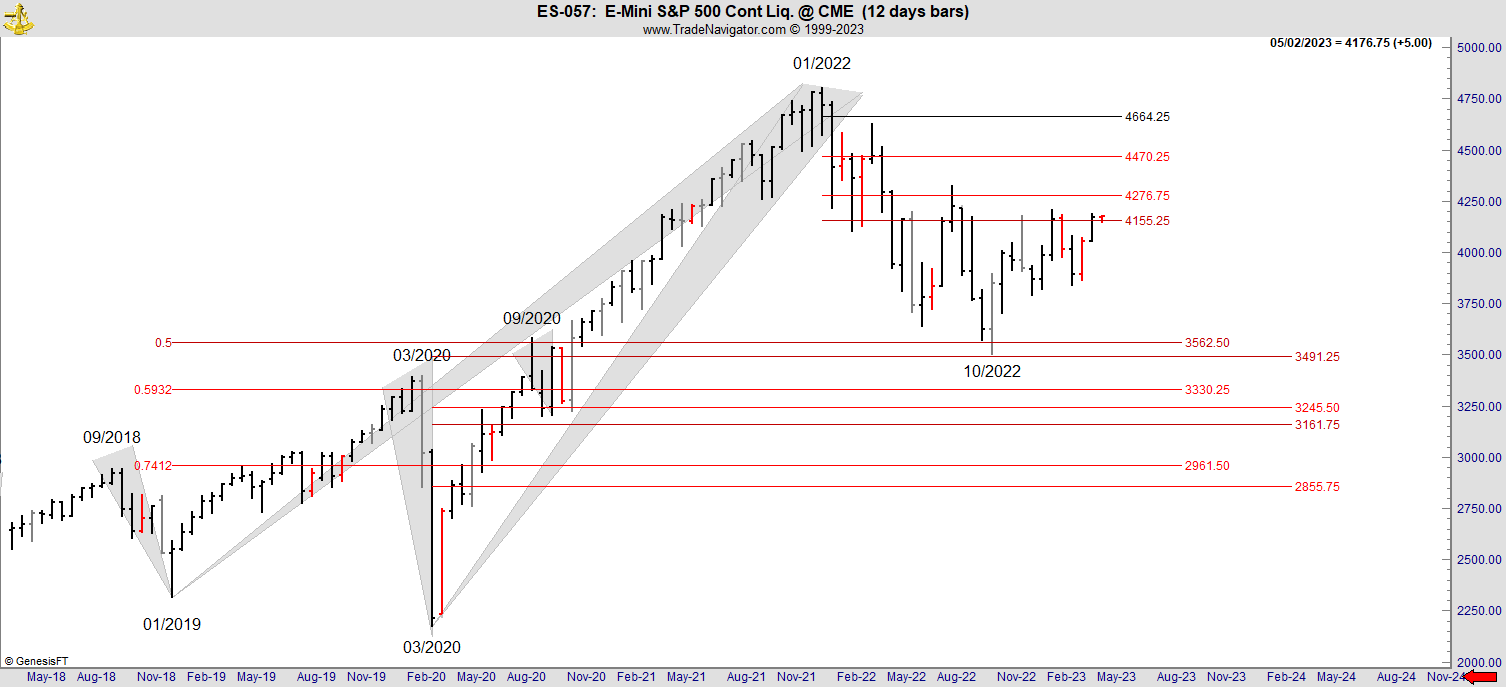

Let us look at those two dates more closely and step

down the time frame to our 12-day chart. Every bar on these charts comprises

twelve trading days, twice our basic market vibration of 6.21. Having

calculated your time cycles from the DC matrix, you can ignore the decimal

points as the missing bars discussed previously mitigate against extension of

time cycles to decimal points or partial days. The improbability of these major

cycles occurring from the 2007-2009 structure marks these corrections as major

players in the cycles to come.

Next, note the major cycles high-to-high and

low-to-low that the 2000 to 2009 charts created. Remember that apart from our

known DC cycles, we are relying on the market itself to show us which cycles

are dominating.

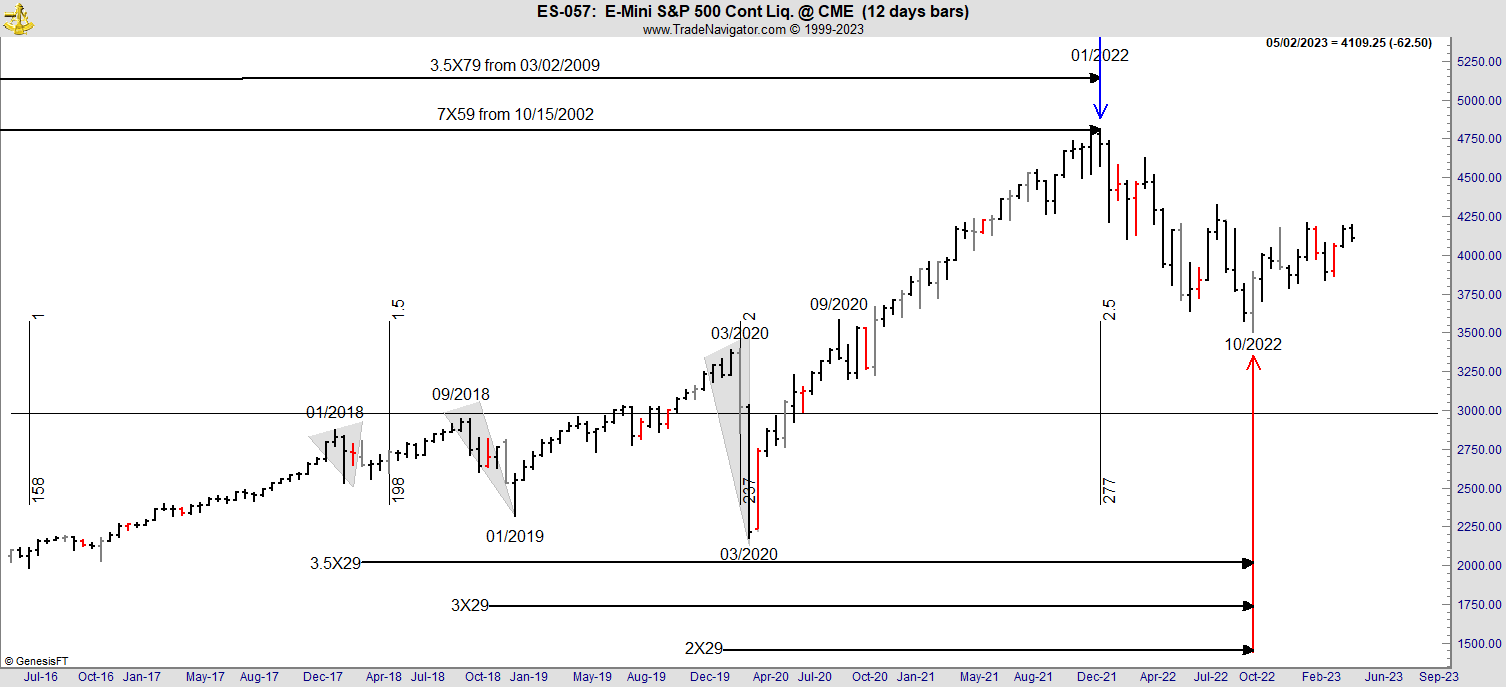

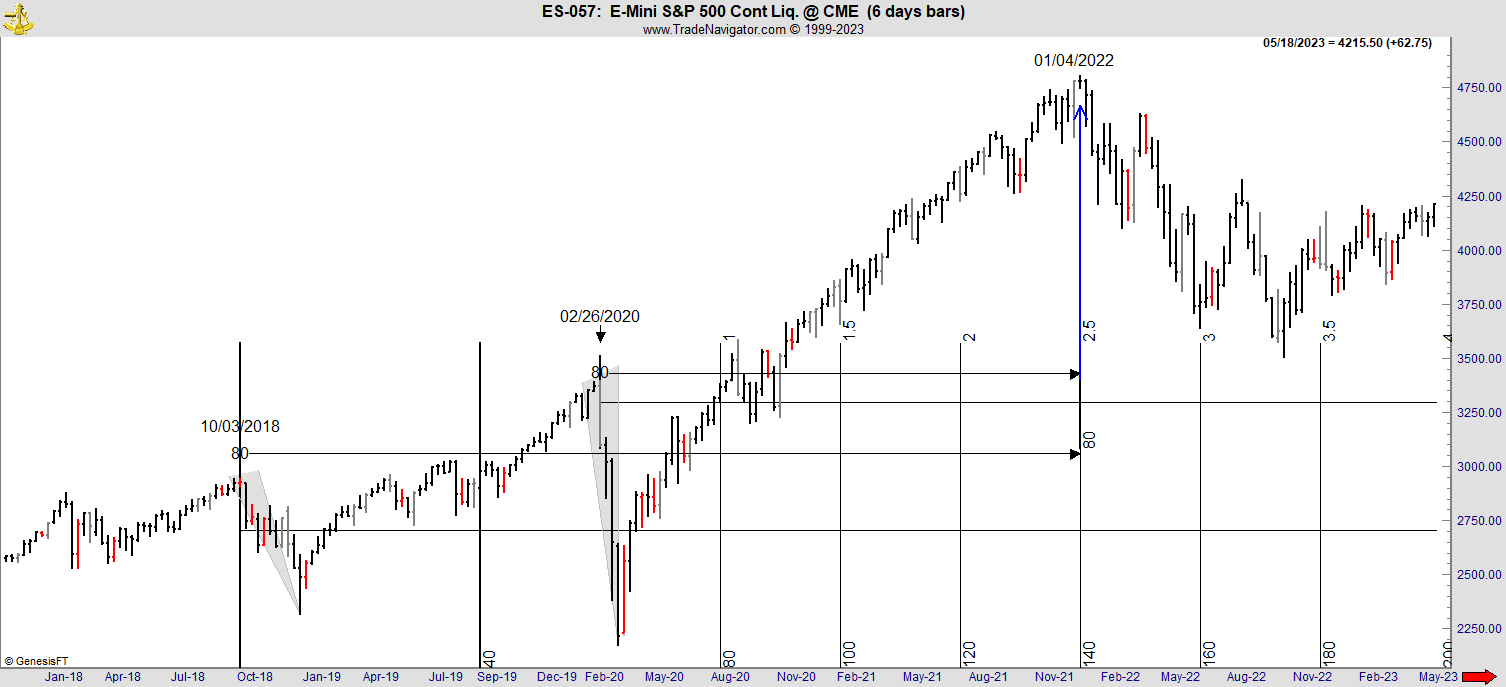

Back to our 24-day chart, we distinguish between swing

highs and momentum highs (closing high) and the same for the lows. On the chart

below, we measure swing high to swing high and momentum low to swing low. The

high-to-high leg measures 80 cycles on the futures chart. On its own this is

not insightful, but if we follow the same process on the Index, we see the

discrepancy as swing high to swing high on the Index is one bar less at 79.

For all of these cycles, both the Futures chart and

the Index are valid data sources. So what do we do when we see a divergence

between the two? Ignore it and go with our preferred option? Hardly. Differences

or divergences between the two data sources are highly revealing and tell us

something. Below is the index chart with its count discrepancy. One bar?

That is not even a rounding error but look what this difference produces:

S&P 500 Index

on a 24-day chart.

To emphasise how important the 2007 high is to time

cycles, the following chart shows how the 79 and 59 cycles, both from the 2007

swing high, give us just one bar before the January 2022 all-time high and the

swing low of the current pullback.

S&P 500 Index

on a 24-day chart.

Random? Not at all. Here is another view:

S&P 500 Index

on a 24-day chart.

So, there are the current highs and lows on our long-term chart. Nice

enough.

These important swing points can be achieved in

several ways, but I refrain from adding charts as you already have quite enough

to think about. However, here is a simple variance:

S&P 500 Emini

Futures contract on a 24-day chart.

The 35 period cycle into the 2022 all-time high is, of

course, a half of 70, the first cycle we examined. Time cycles come from the

Danielcode and from the market itself.

The 12-Day Charts

Let us switch now to our 12-day chart where every bar

is comprised of twelve trading days. We saw how potent the 79 cycle from the

missing bar on the Index was on our really long-term charts, so let’s start

with that on the twelve. We will add the 70 cycle from Danielcode, so here we

demonstrate time cycles from our host Daniel’s Code and from the market

expressing itself by showing us a simple one bar variance on the cycle count

between the S&P 500 Futures chart and the Index.

Now one bar is not even a rounding error on our

long-term charts, so why not ignore it? That is the subtlety of these Time

signals. Markets are talking to us. They have always been trying to talk to us,

but before the Danielcode, we simply did not have the language to understand them.

Now we do. Markets are working hard to enhance your prosperity if only you

could understand.

Look at the chart below; simple, clean, and

sensational. Note how the 2009 closing low gave us the 2022 closing high, while

the 70 cycle from the 09/2018 high gave us the all-time swing high. Time rules.

S&P 500

Futures on a 12-day chart.

The 70 cycle, which we have seen has been active since

at least Black Monday in October 1987 and is, as previously stated, still

active immediately shows us the 2022 all-time high. We can now add some

Danielcode ratios. The first two Danielcode numbers at 29 and 44 combine to

give us two completed cycles at the October 2022 low. Note how these cycles

have picked up the December 2018 and COVID-19 flash crash, closing highs to

anchor their start points.

S&P 500 Emini

Futures on a 12-day chart.

The important 59 cycle found the 09/2018 and the COVID

flash crash highs at 03/2022, respectively, on our long-term 24-day charts.

These were the two biggest pullbacks between 2009 and the all-time high in

January 2022. In addition, they were found exactly at their respective

highs to the bar. The statistical probability of that being accomplished blurs

the eyes. These two market corrections will anchor our time cycles for the

foreseeable future.

Think about this for a moment; COVID was running

rampant well before 03/2020 with no effect on markets. Then suddenly, it

mattered with the COVID flash crash creating the shortest Bear Market in

history, and 23 trading days later, it did not matter at all as this market

went on to make new highs. So why was the market waiting for the vital 59 cycle

to expire? That is something to ponder as Daniel’s Code rules the twelve-day

chart equally.

S&P 500 Emini

Futures on a 12 day chart

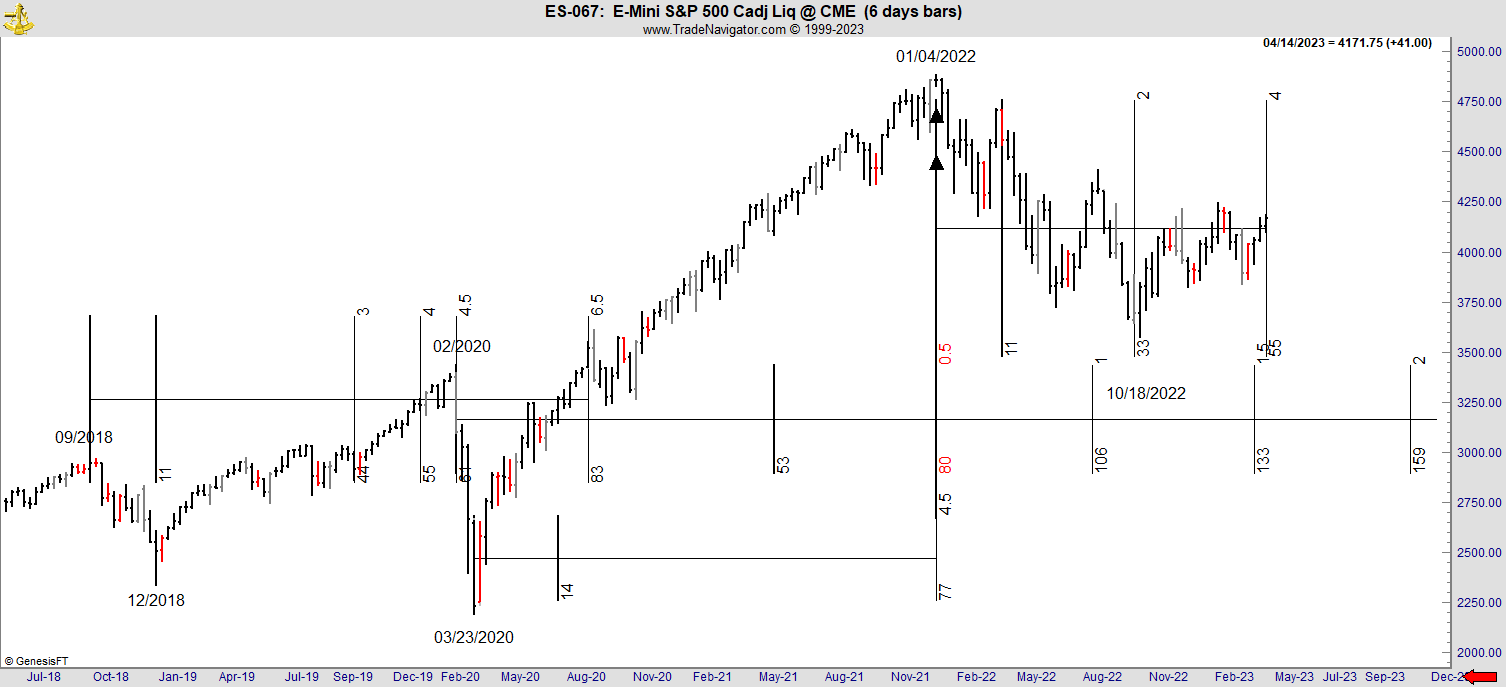

The 6-Day Charts

This is the base of our timing charts, allowing us to see the major inflections in

the market while narrowing the time period for expected trend changes. The

feature that cycle expiration delivers on these longer-term charts is

definitive trend changes, which is the basis of all market analysis.

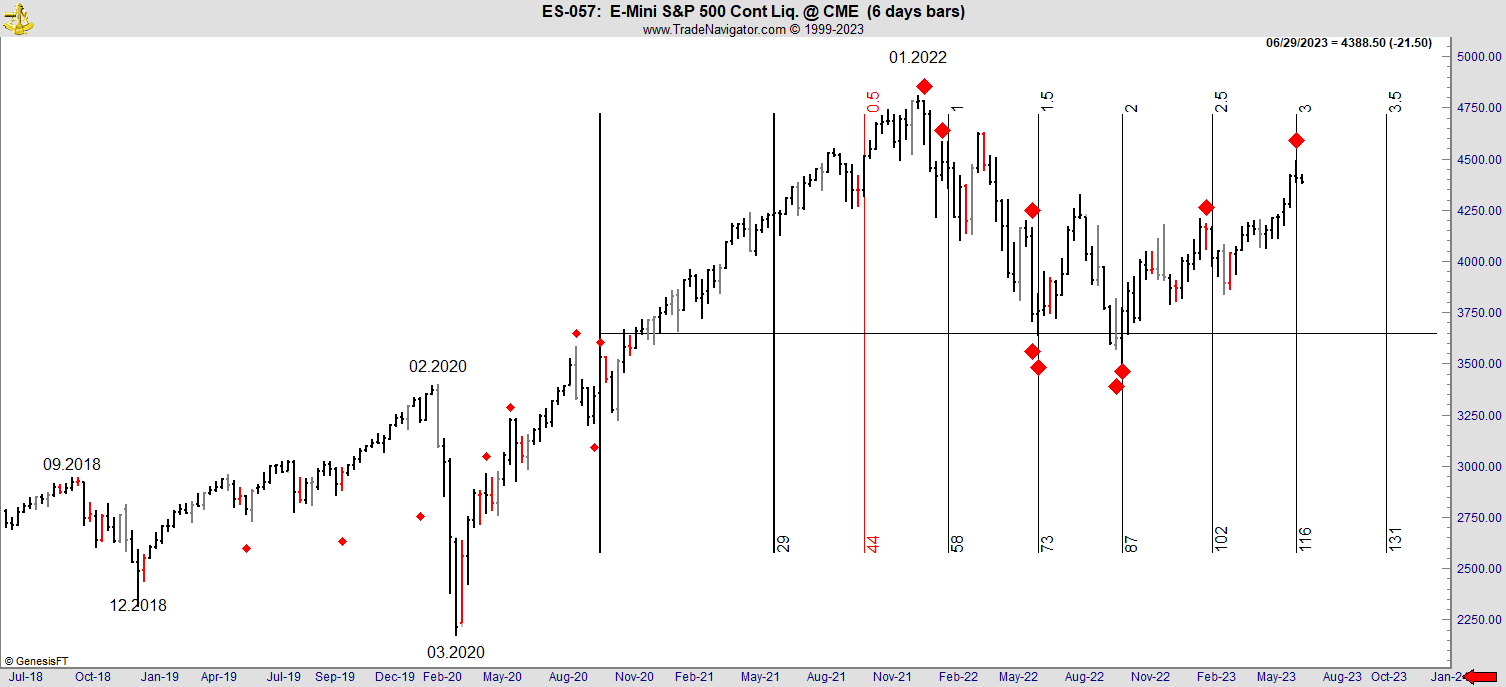

Below

you can see our old friend the 80 cycle reapearing whilst after the 01/2022 top

we see the 33 cycle called the ‘Trine’ working. The Trine is most unusual on

Futures charts and is more usually associated with large cap stocks.

6 day chart of S&P 500

Futures

Recall that the dominant Time ratios for this market

are 29 and 58. Time as 29.5 days creates 59 as Times so they are

interchangeable.

S&P Emini

Futures on a 6-day chart.

Running our base 29 cycle from the important 09/2018

swing high creates the small red diamond dates on the chart above. And we know

that Time repeats, doubles and halves so simply using a few of the important

cycles around the 09/2018 and 02/2020 flash crash corrections goes on to show

us every important cycle ending since the 2022 top.

These cycles are by no means exclusive but they do

highlight the massive advantage that accrues from an understanding of trading

Time.

S&P 500 Emini

Futures on a 6-day chart.

Remember that on the very first chart in this document

we compared the different high to high measurement from the 2000 Dot.Com swing

high to the 2007 swing high on the S&P Index and its Futures on the 24 day

chart. Recall that the Futures measurement was 80 and now we see it again on

the 6 day chart at a different level now revolving around the important 2018

and 2020 corrections. We take the 80 cycle from the closing high of the 2018

correction and the swing high of the major 2020 correction and they combine to

give us the January 2022 all-time high. Precisely!

6 day S&P

Emini Futures chart

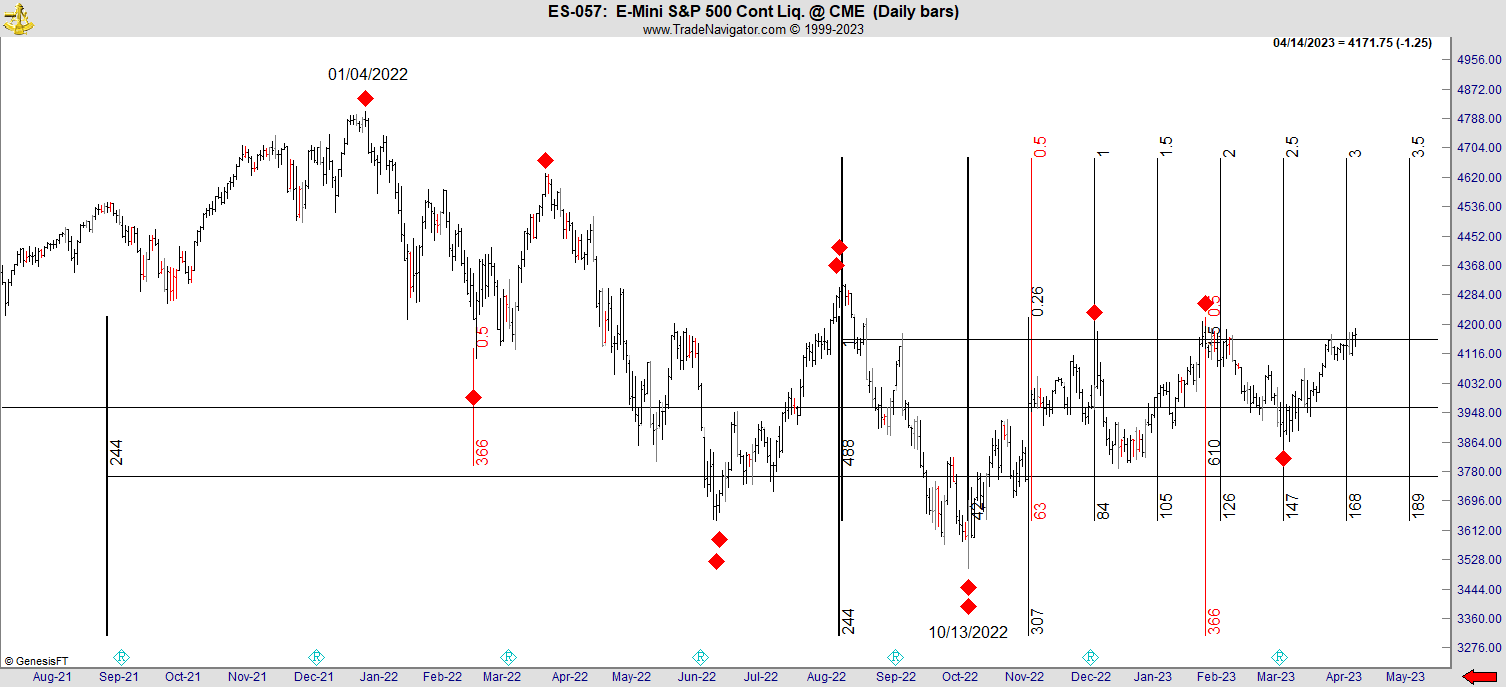

The Daily Charts-S&P

As we go down the Time cycles, we have more inflection

points and, therefore, more trade signals. We have better ways of trading daily

charts, but the chart below will suffice. Note that for the S&P daily

below, we are using simple swing analysis to highlight the market moves and

then the length of each respective swing to create its own Time cycle.

Basically, we can expect to get every turn on a daily chart identified and

signalled in advance.

S&P 500 Emini

Futures on a daily chart.

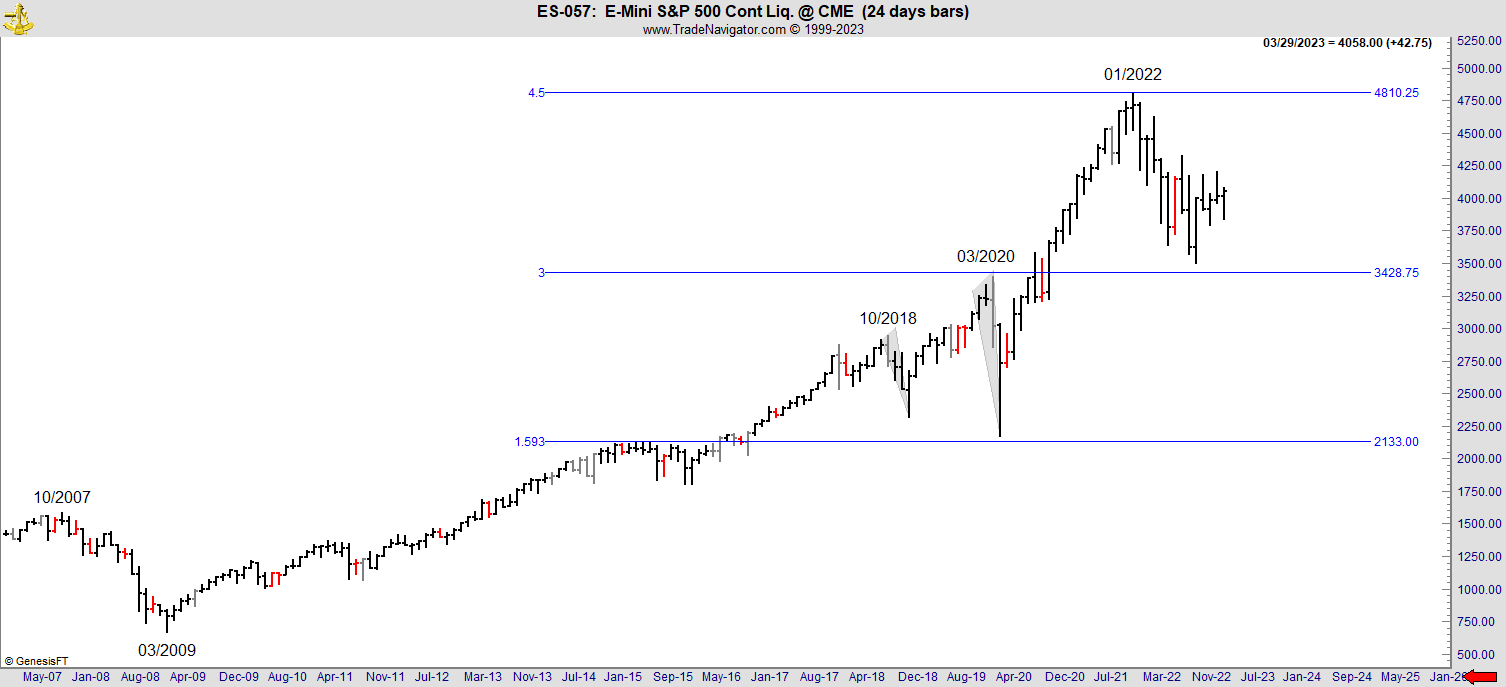

What about Price?

We know that the 2007 to 2009 leg of the MBS, CDO, and

GFC carnage has ruled future Time cycles, and since Time and Price are the

same thing on a different axis, it is no surprise that the 2009 to 2022 Bull

Market ran up precisely 4.5 times the 2007 to 2009 final leg down.

S&P 500 Emini

Futures contract on a 24-day chart.

The muted pullback from the 2022 high has been in

perfect Danielcode retracements. First to the 2019 swing low and then the 2020

swing low, each marked by the repeating 59 cycles from the 2007 high and 2009

low.

S&P 500 Emini

Futures contract on a 12-day chart.

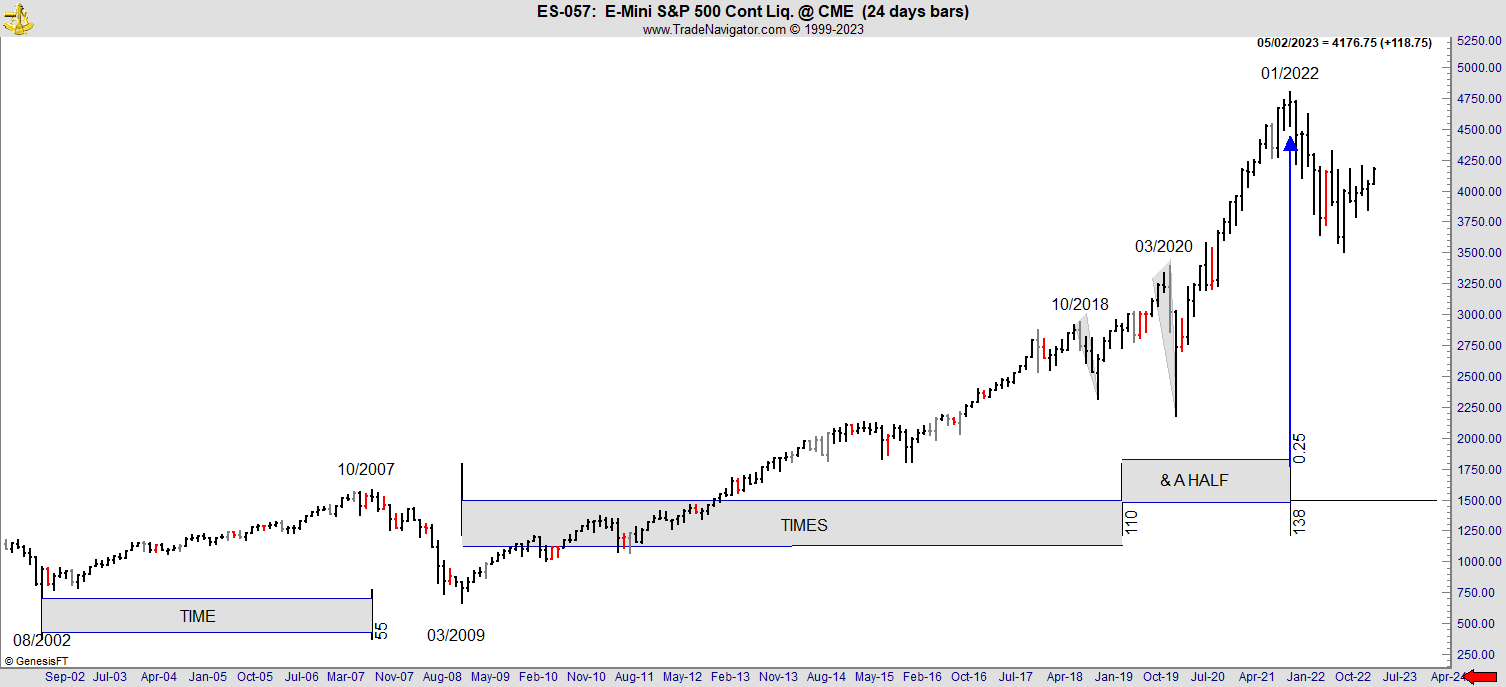

Let me show you how prescient Daniel’s Code is. You

will recall that the code states Time progresses as Time, Times and a half.

Here is the definitive Time chart on S&P since the 2002 low which was the

Dot.Com crash.

S&P 500

Futures contract on a 24-day chart.

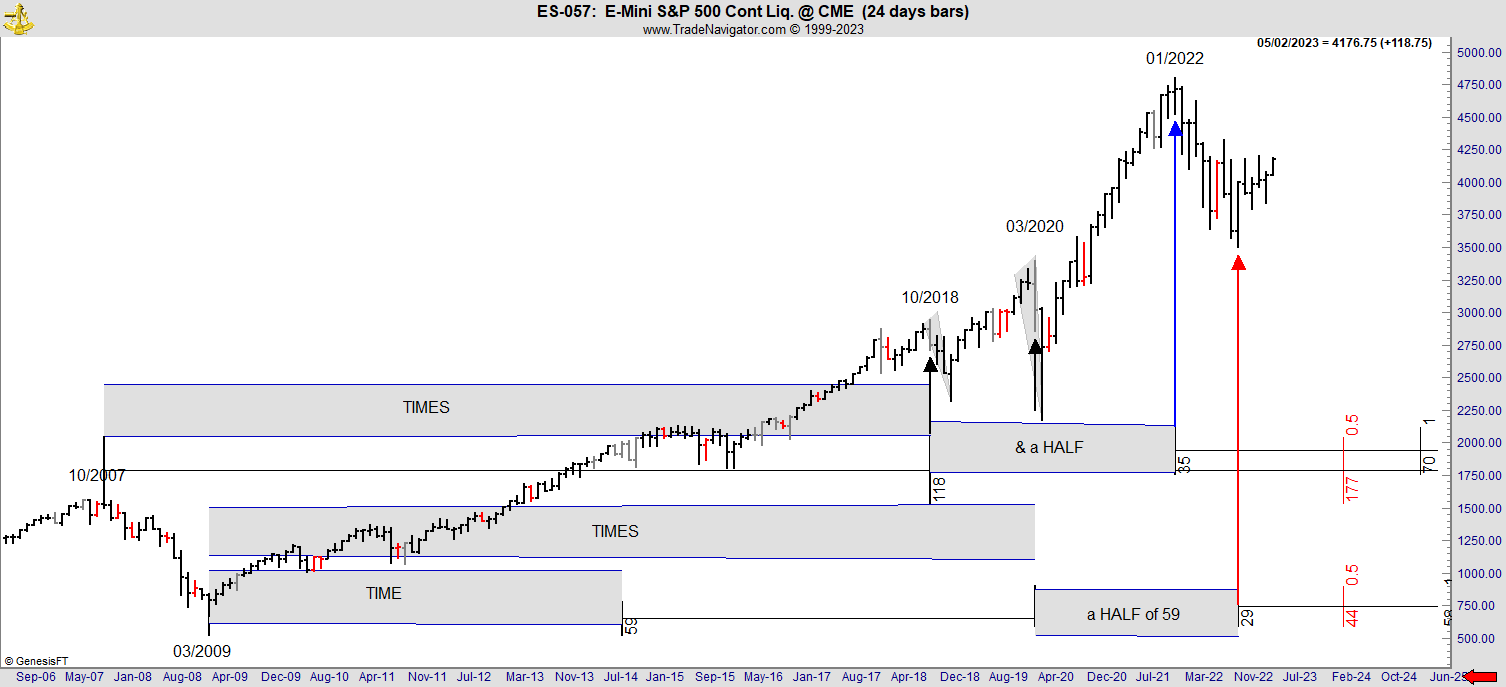

And…

S&P 500 Emini

Futures contract on a 24-day chart.

Time, Times and a half – the endless cycle of Time.

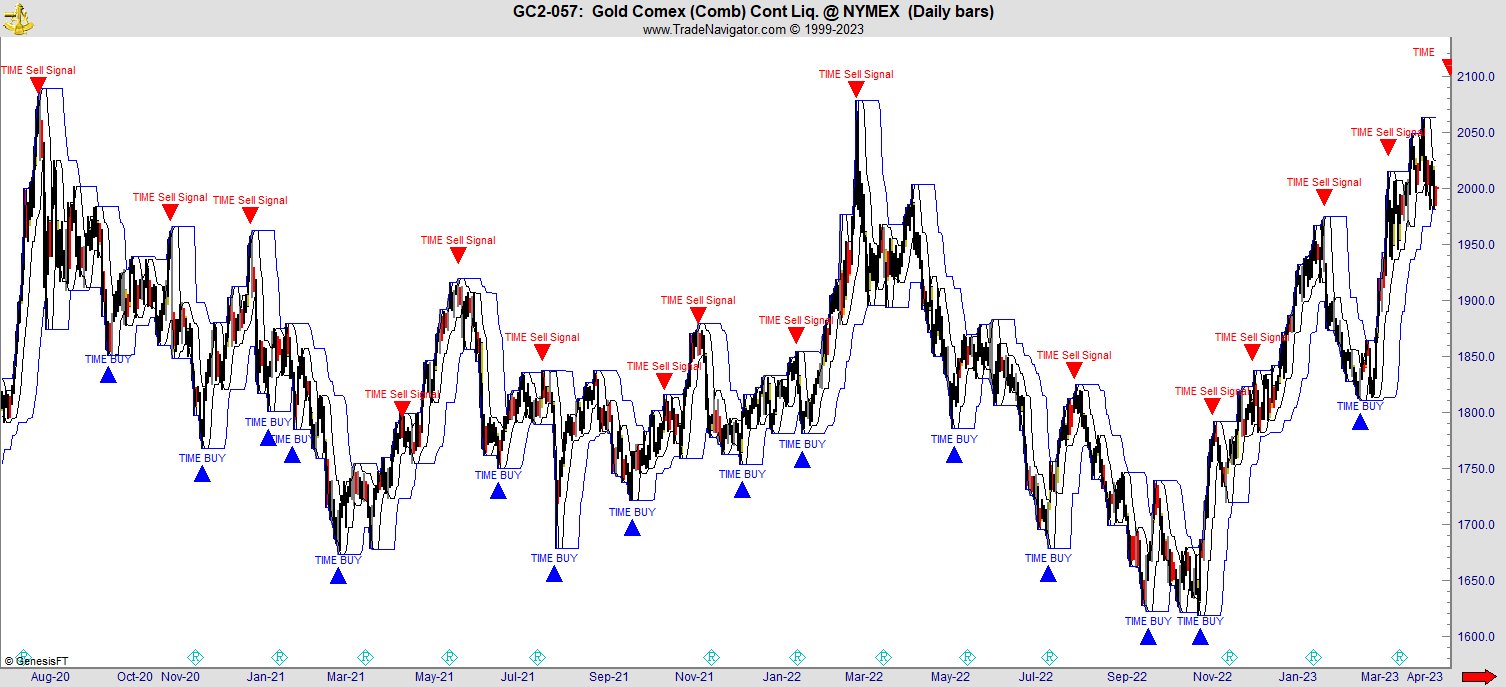

Application of the Danielcode is not simply restricted

to the markets discussed above. Indeed, at the Danielcode we emphasise this is

not a simple theoretical exercise in pondering the market turns but has

immediate real-world benefits. See the following chart:

This is a daily chart of Comex Gold Futures from July

2020 to April 2023 or almost three years. I have simply used our basic 29.6 Time

cycle to create these Buy and Sell signals. These are not the only signals

created but it illustrates starkly that every important turn without exception

comes at a Danielcode Time Cycle. We trade significantly shorter Time signals

which in a similar vein allow us to capture every turn and to see those Time

signals days in advance. Using shorter but compatible Time cycles ensures you

will never miss an important market turn. Time trading is a whole new universe

and works exactly the same for all Futures and Forex markets. Do you see it

now?

The other way to market

knowledge, predictability, and substantially increased profit.

The other way to market

knowledge, predictability, and substantially increased profit.

If you have found this article interesting, please

share it with a friend and visit us at www.thedanielcode.com where we work every day to

make you a better, safer, and stronger trader.

John Needham is an Australian Attorney who lives on

Queensland’s Gold Coast and trades, teaches, and thinks about what makes

markets turn.

John Needham

17 July 2023

© John Needham 2023

Disclaimer: All the reports, charts and content in the Danielcode web site are for educational purposes only and do not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author only and should be treated as such. Before acting on any of the ideas expressed, the reader should seek professional advice from a licensed broker in the appropriate jurisdiction.

Risk Disclosure for Front Page, Long Term Trend Charts: THE RISK OF LOSS TRADING COMMODITIES OR FUTURES CAN BE SUBSTANTIAL. COMMODITY TRADING HAS LARGE POTENTIAL RISKS, IN ADDITION TO ANY POTENTIAL REWARDS. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THE FUTURES OR COMMODITIES MARKETS. DON'T TRADE WITH MONEY YOU CAN'T AFFORD TO LOSE. THIS IS NEITHER A SOLICITATION NOR AN OFFER TO BUY OR SELL COMMODITY INTERESTS. THE USE OR PLACEMENT OF ANY STOP-LOSS OR STOP-LIMIT ORDERS MAY NOT LIMIT YOUR LOSSES AND YOU COULD LOSE MORE THAN YOUR INTENDED AMOUNT OF MONEY AT RISK. PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT INDICATIVE OF FUTURE RESULTS.

Risk Disclosure for Genie Results, T.03, T.03+ and TradeProgram: HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.