Traders, Bankers, Commentators and the whole panoply of the

trading world are obsessive in their search for the one study, tool or device

which is going to enhance their trading and resultant profits. The trading

world is awash with tools and studies that profess to determine trend,

strength, exit targets and anything else you can think of but I maintain that

nothing compares with the Danielcode chart number. I have been using these price

levels for the past twenty-eight years and we have presented them in the public

domain at www.thedanielcode.com since late 2008.

Trigger Warning: This article uses some maths and a bit of

geometry. If you are not into numbers don’t panic as we do all the calculations

for you.

In that time we have created over 40,000 Members charts which

list the important price levels in the Futures and Forex markets we cover. Members

Charts are created every weekend and on Wednesday evening and more often as

required. We call these price levels “targets” and target recognition is

achieved in a very special way; in a rallying market target recognition is

achieved at the bar high or the close. In a pullback target recognition is

achieved at the bar low or the close. Additionally that target recognition is

only valid if the Bar high/low or close is within 0.1% of the target Not 1% but

0.1% or 1 tenth of 1% so it is very specific. Since the website started in 2008

each of the Members charts is posted on the website on the day they are created

and after 30 days those charts are automatically posted to the Chart Archives

tab. Take a look at these over 45,000 charts created since 2008 and you will be

hard pressed to find a market that has turned anywhere except at its DC numbers.

In fact we maintain that markets turn at and only at the DC numbers.

Theoretically the

DC ratios run from zero to infinity but fortunately markets continually select

the same five patterns over 92% of the time and it is these patterns which

populate our members charts. But there is more; going on a deep dive of the

DC Time and Price ratios reveals a plethora of minor cycles which we monitor on

a daily basis. We don’t want to crowd out our charts with all the possible

levels so we post the primary levels but monitor the additional probabilities

for signal opportunities. So we are a bit like the beautiful swan cruising along

the placid lake. Above the water all is calm and peaceful. Below the water the

picture is reversed as the swan paddles fiercely to push itself along. As a

matter of interest black swans are common down under!

Theoretically the

DC ratios run from zero to infinity but fortunately markets continually select

the same five patterns over 92% of the time and it is these patterns which

populate our members charts. But there is more; going on a deep dive of the

DC Time and Price ratios reveals a plethora of minor cycles which we monitor on

a daily basis. We don’t want to crowd out our charts with all the possible

levels so we post the primary levels but monitor the additional probabilities

for signal opportunities. So we are a bit like the beautiful swan cruising along

the placid lake. Above the water all is calm and peaceful. Below the water the

picture is reversed as the swan paddles fiercely to push itself along. As a

matter of interest black swans are common down under!

These DC numbers are derived from the DC Time ratios which

themselves are simply fractals of observable natural ratios that happen in our

world every day. We then use these Time ratios as Price ratios as Time and

Price are the same thing on different axis. That may surprise you but hold fire

until you see how accurately these Time cycles delineate Price. Our assumption

about charts is that all available knowledge of market forces is known by the

market and must be revealed in its Price action. Let’s start with a detailed

analysis of the S&P Emini chart one of the most traded and popular markets

of all. The swings immediately either side of an important high or low set the

scene for what follows. The charts themselves create all of the strategy that

follows.

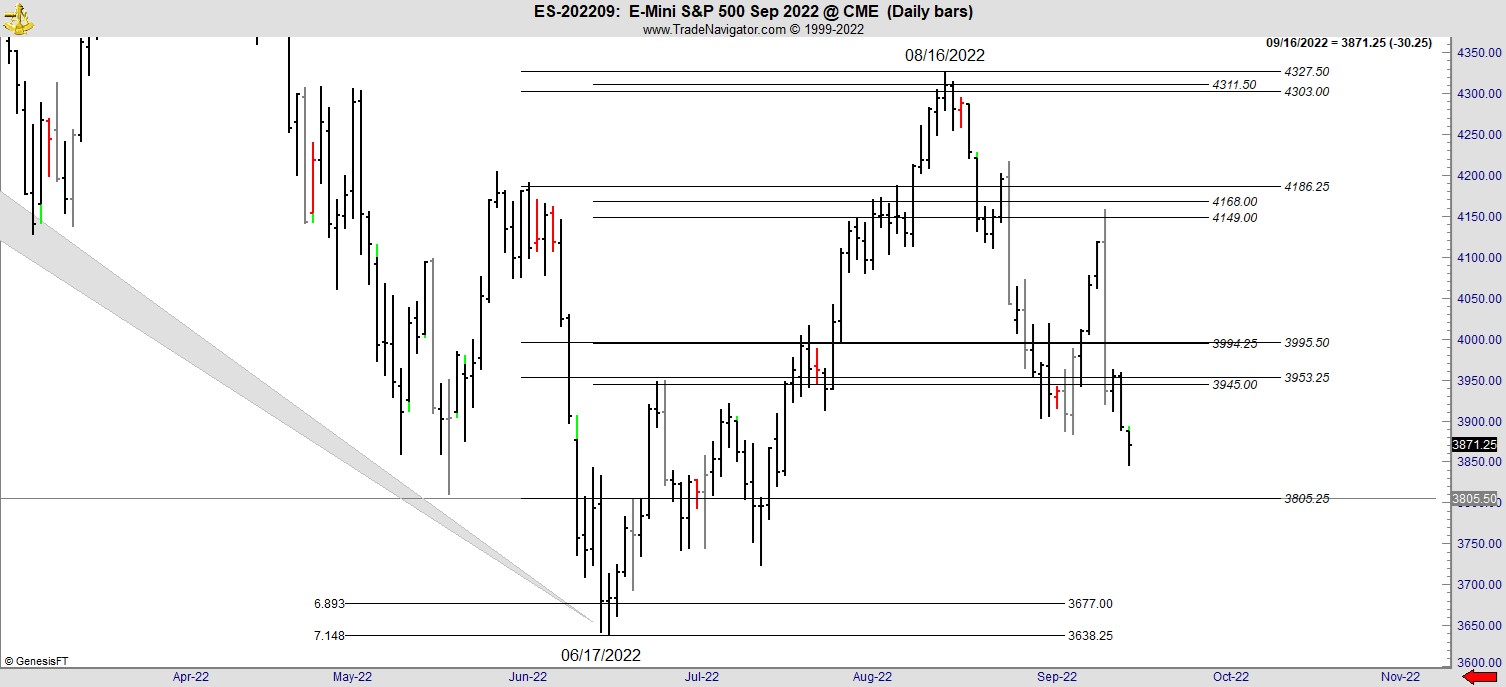

This is the September 2022 Emini chart which gave us the 01/04/2022

all-time high and the important 03/17/2022 low.

The first retracement after the all-time high gives you the

chart low and the closing low 1n June 2022. The close of 06/16 was 3680.00

against the DC target at 3677.00. The variance between market and the relevant

DC number is 3 points and the allowable variance at 0.1% for this price level

is 3.68 points. Ergo we have target recognition. The next day 06/17/2022 gives

us the then low for this pullback at 3639.00 against the DC number at 3638.25

and with a variance from target of just 0.75 we again have target recognition. And

from that low we had the “most hated rally” because most of the hedgies missed the turn and the rally ran 689 points or

almost 59% (a DC ratio) of the whole move down to 06/2022. Note that the

January high came in the March 2022 contract whilst the June low came in the September

2022 contract. We have made no adjustments on rollover.

Let’s turn to the rally which happens on the September 2022 chart.

These DC numbers work exactly the same on the index or on a continuous chart

provide it is not back adjusted.

Using simply the swing immediately before and immediately

after the 03/17 low we have got every important high of the rally either at the

high or the close on the relevant bar. When you consider that all turns happen after

target recognition you can see what a huge advantage the DC ratios give you.

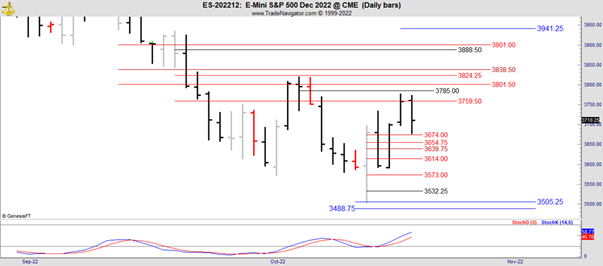

Let’s move now to the December 2022 ES chart to find the

significant vibrations for this last leg down.

The low on Friday 09/30 was 3595.25 lust three tics variance

from the blue line at 3596.00 and that was target recognition which setup the

Buy signal for the new week. To get you right up to date, below is the current

S&P Emini Futures chart. Thursday 10/13/22 lived up to its unlucky date but

still managed to tag the DC Blue line at the current low. And there you have

it. Even as this market ponders its future direction it does so with strict

observance of the DC ratios at its high/low or close:

The prerequisite for any market turn whether small or

big is DC target recognition. All markets turn at and only at the Danielcode

ratios. By using these amazing support and resistance ratios your trading will

be a deal better.

Finally a close above 3577.03

on the index chart $SPX will confirm a key reversal bar on the 6 day chart

which completes its current bar on Thursday. A KRB from known DC support is a

powerful directional signal. Additionally the index has bottomed for now just a

few points below the 50% retracement and that may be sufficient for a while.

We invite you to visit us at www.thedanielcode.com to see what we do. A free trial is

available. John Needham is an Australian  Attorney who has been trading Futures and Forex since 1994 and teaching

folks to trade since 2004

Attorney who has been trading Futures and Forex since 1994 and teaching

folks to trade since 2004

20 October 2022

Disclaimer: All the reports, charts and content in the Danielcode web site are for educational purposes only and do not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author only and should be treated as such. Before acting on any of the ideas expressed, the reader should seek professional advice from a licensed broker in the appropriate jurisdiction.

Risk Disclosure for Front Page, Long Term Trend Charts: THE RISK OF LOSS TRADING COMMODITIES OR FUTURES CAN BE SUBSTANTIAL. COMMODITY TRADING HAS LARGE POTENTIAL RISKS, IN ADDITION TO ANY POTENTIAL REWARDS. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THE FUTURES OR COMMODITIES MARKETS. DON'T TRADE WITH MONEY YOU CAN'T AFFORD TO LOSE. THIS IS NEITHER A SOLICITATION NOR AN OFFER TO BUY OR SELL COMMODITY INTERESTS. THE USE OR PLACEMENT OF ANY STOP-LOSS OR STOP-LIMIT ORDERS MAY NOT LIMIT YOUR LOSSES AND YOU COULD LOSE MORE THAN YOUR INTENDED AMOUNT OF MONEY AT RISK. PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT INDICATIVE OF FUTURE RESULTS.

Risk Disclosure for Genie Results, T.03, T.03+ and TradeProgram: HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.