“To every thing there is a season, and a time to every purpose under the heaven”

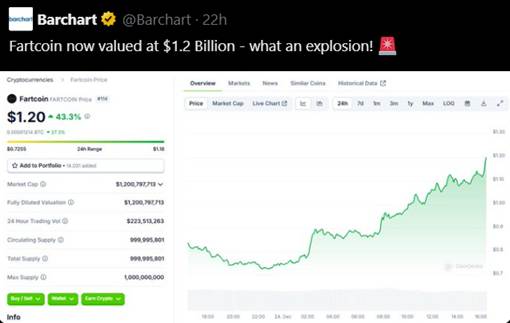

We live in extraordinary times. At the high of an amazing

bull market that started in March 2009. A bull market that has fostered social

decay and has pushed asset valuations to astronomical levels. A bull market

that even gave birth to imaginary cryptocoins plotted on exponential moving

graphs all under the pretense of claiming to be the future of self custody

money with a strong “asset” value. A bull market, that made us forget what is

right and what is wrong, what is man and what is women, what is a war crime and

what is not, what is corrupt and what is not. Mankind has lost it. And the

declining group of straight thinking people

increasingly hide behind the warm blanket of apathy and inflated balance

sheets. We simply stopped caring about it, a gift that was so eloquently

bestowed upon our souls at birth.

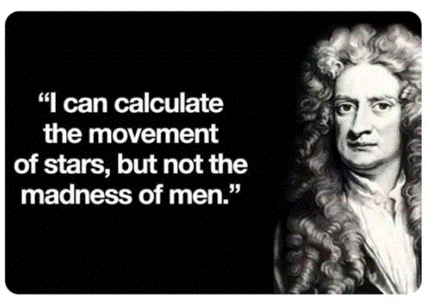

Relax. This is the good part of this article. At some point

everything will change. In a BIG way. The picture on the next page of Isaac is

again timely as ever as this obviously very intelligent man who lost most of

his wealth during the Great Depression admitted that he could not foresee the

opposite site of a bubble. It is a warning to all of us that no matter how

smart you are, predicting major market turns is beyond human intelligence. Does

that mean it cannot be done? Yes it can. Forget about

what you know about markets and start to think about what you believe.

14 years ago I had to privilege to

attend a DanielCode seminar by John Needham next to the blue waters of lake

Taupo in New Zealand. I had never seen a futures chart and had below average

knowledge about markets but I was excited to meet the

man I had been following for a year. What came was a week full of the most

amazing insights in markets. We all tend to think that

markets move randomly and are not revealing their next move. John on the other

hand stood on the opposite side of that proposition and claimed that markets

are ruled by a mathematical sequence hidden in the book of Daniel in the old testament.

“Markets

are perfectly mathematically organized and sometimes even predictable”

John Needham

And boy, was he right. While most of us would consider what

the hell this guy is smoking I had been studying him

for a while and something inside me told me he was on to something. I was super

focused that week and sucked up all the knowledge and insights I could get out

of it. I came back home knowing that the DanielCode time cycle studies were my

“thing” and have been perfecting the skill ever since. What I can tell you now,

beyond a shadow of a doubt, is that the DanielCode is the biggest discovery

about markets ever made. It is the only tool that will give you predictive and

very precise insights in market turns. Markets can not turn without a DC time cycle. Markets track DC time

cycles and price levels all the time on all time frames. Markets vibrate in DC

time. They talk to us in DC language.

Show me the money

I can of course entertain you with fancy stories but I’m sure

you are already bored, ready to skip this article. You want to see the fruit

and you want to see it now. Well, nobody knows what the future will bring but

we at the DanielCode claim that markets are ruled by time and can only make

significant turns at major DanielCode time cycles. And we make that claim hard.

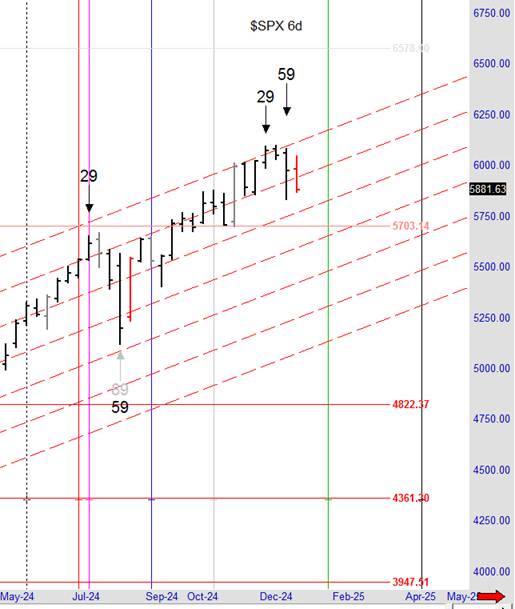

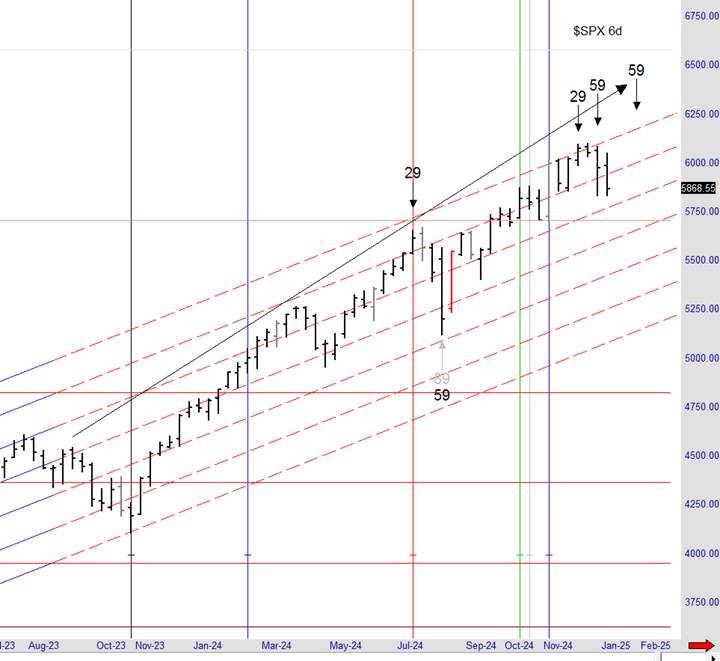

As we entered the end of 2024 we were facing a major

59 time cycle top in $SPX late December.

As we entered this 59 cycle top you

notice that price was already going down before we

arrived at the cycle date. Equities had started a sell

off slightly before the December FED meeting and continued their decline as the

cycle came. That is not a perfect setup for the 59 cycle.

For a major high to be formed price must rally exactly into the cycle and make

a new all time high as we enter the 6 trading day time

window of the 59 cycle top. This was not the case here. Price did not confirm time and markets only turn when price and time are squared.

Looking closer you noticed that $SPX actually made a closing high on the 29 cycle top, a setup very similar to the July Top. There is

also a good chance that, just like in July, this 59 cycle

top could invert into a low instead of high. Regardless, all of this means that

the amazing bull market that started in March 2009 has not yet run its course

and that after whatever correction comes here, higher prices will prevail and the all time high of now will be broken. $SPX needs a 59 cycle top to finish the bull and the setup must be very

precise for both time and price.

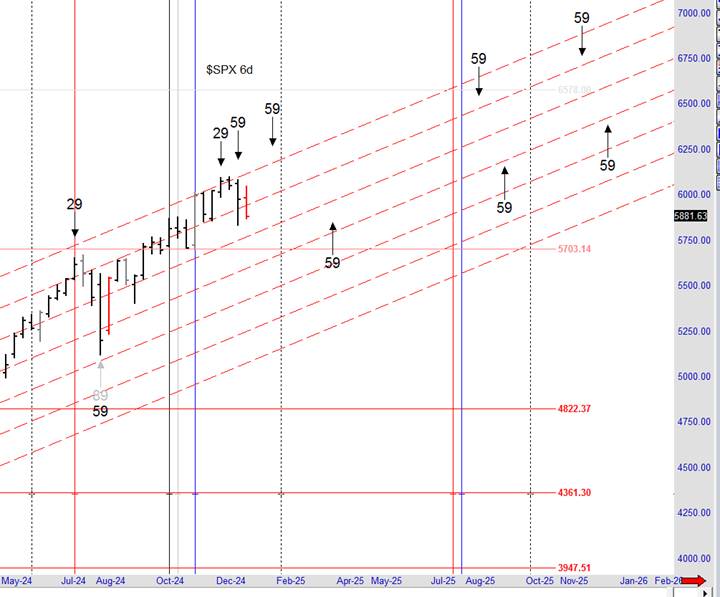

On the next page I show a 6 trading

day chart of $SPX with all the significant 59 cycles drawn for 2025. Each bar is 6 trading days which represent a DanielCode week.

You immediately notice 6 different 59 cycles, 3 top cycles

and 3 bottom cycles. Each of these cycles can invert

(high becomes low or low becomes high) and each of them have different weight

and meaning which requires experience to read. We are looking for a major high

of this bull market and for that we need a 59 cycle

top coming from a swing high. That puts our focus on the 3 different 59 cycle

tops for 2025, one late January, one late August and one early December. I will

focus on the August and December cycle as they approach in the weekly 4th

seal updates on the DC website. For now my attention

goes to late January as this one is closest and it is also the most subtle of

the three 59 cycles which probably makes it the most important.

The TRUMP top?

Notice how we got the 59 cycle top

late December. The market went down already on a 29 cycle

closing high before the 59 cycle came up. This eliminated the chance for a

major high late December and simply means this bull market remains alive and

kicking.

The next focus is the 59 cycle top

that starts to bite on 1/21 and runs until 1/28 counted from the closing high

and 1 DC week later (1/29 until 2/5) counted from the momentum high. This is

the next point of focus for the potential end of this bull market. You

immediately notice that the point of origin for this cycle is the small counter

trend swing high late August 2023. It almost seems

insignificant or unimportant. From experience however

I can tell you that these small subtle cycles are more important than cycles

expiring from big swing highs or swing lows. The market talks to you all the

time through DC numbers and there is nothing that the market loves more than to

fool you. Small is big, big is small and nothing is what it seems. That alone

gets my attention.

But there is more. If you haven’t read the book of Daniel in

the old testament yet, I urge you to do so. All wisdom

about markets is hidden there in plain sight. I know how it sounds but it is

this stuff that keeps us at the right side of this amazing bull market and it will also be this stuff that gets us across

the top safely. One of the most important verses in the book of Daniel:

“And I

heard the man clothed in linen, who was above the waters of the river, when he

lifted up his right hand and his left hand unto heaven, and swore by Him that

liveth for ever that it shall be for a time, times, and a half; and when they

have made an end of breaking in pieces the power of the holy people, all these

things shall be finished.”

Daniel 12:7

It shall be for a time, times (two times) and a half (half a

time). If I can count correctly that is 1 time + 2 times + 0.5 time which added

together is 3.5 times. From experience we know that the basic time vibration

for $SPX is 59. This actually comes from the 59.333

number in the DC matrix. Let’s do some math.

3.5 times 59.333 = 207.666

You can round that to 207 or 208 but we need a whole number

for a cycle.

Now let’s do some drawing.

You will probably need to enlarge it to see it but when you

calculate 207 cycles from the high that gave us the covid crash which is 3.5

times 59 you arrive on top of the same 59 cycle top that comes along in about 3

weeks from now. These cycles overlap perfectly and that adds more weight to

this coming 59 cycle top.

“Will two walk together, except they have agreed?”

Amos 3:3

And this just became a classic case of Amos 3:3 where 2

“walking together” have more weight than one which puts this 59

cycle top coming up late January on our radar as the next opportunity to

kill the bull. Since this cycle comes along around Trump’s inauguration I call

it the Trump top. More DC knowledge will reveal itself as we get closer and I will keep you informed through the 4th

seal channel on the DC website. The first requirement for this cycle to bite is

that we need a rising market with $SPX making new all time

highs as we enter the time window for this cycle. The time window is basically

a 2 DC week window because you can count the 59 cycle

from a closing high or a momentum high and also because we could use 207 or 208

as the 3.5 times 59.333. Late January is the focus and since that is not that

far away we need the market to go higher as soon as

the first full trading week of January. We will know soon if the market will

take this opportunity.

Until then we remain overall bullish. This bull market can

not end without a 59 cycle top. Any downside remains

just a correction without a 59 cycle top. If we go

lower from here it simply means a bigger correction will follow

after which equities will seek higher prices again. Only a proper 59

cycle top can end this huge bull market that started in March 2009 with the

first opportunity for this year coming up late January. It will become clear

soon.

And that’s a wrap. The DC will keep us informed and the

market speaks to us in DC language. We only have to

believe and learn to understand. All wisdom of markets is hidden in the

DanielCode. One warning. It is not our job to become prophets

nor do I want to emulate what Isaac Newton described as “the folly of

interpreters”. I’m just the messenger here. I read the Danielcode numbers on

financial charts. I look at financial markets through Danielcode lenses and try

to translate what it is telling in plain English. I encourage you to study this

stuff. I promise you, you will be amazed. Markets are

ruled by the Danielcode. Markets move within the boundaries of Danielcode

numbers and make turns on Danielcode time cycles. If we want to know what is ahead we have to listen what it is

telling us. The only limitation that the Danielcode has in forecasting markets

is our ability to decipher it. Thank you for reading!

“The fear of

the Lord is the beginning of wisdom; all those who practice it have a good

understanding”

Psalm 111:10

Isaac Newton knew that there was major knowledge

hidden in the Book of Daniel. He gives us solid warnings.

John Needham

Frank De Baere

Belgium

January 2025

Disclaimer: All the reports, charts and content in the Danielcode web site are for educational purposes only and do not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author only and should be treated as such. Before acting on any of the ideas expressed, the reader should seek professional advice from a licensed broker in the appropriate jurisdiction.

Risk Disclosure for Front Page, Long Term Trend Charts: THE RISK OF LOSS TRADING COMMODITIES OR FUTURES CAN BE SUBSTANTIAL. COMMODITY TRADING HAS LARGE POTENTIAL RISKS, IN ADDITION TO ANY POTENTIAL REWARDS. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THE FUTURES OR COMMODITIES MARKETS. DON'T TRADE WITH MONEY YOU CAN'T AFFORD TO LOSE. THIS IS NEITHER A SOLICITATION NOR AN OFFER TO BUY OR SELL COMMODITY INTERESTS. THE USE OR PLACEMENT OF ANY STOP-LOSS OR STOP-LIMIT ORDERS MAY NOT LIMIT YOUR LOSSES AND YOU COULD LOSE MORE THAN YOUR INTENDED AMOUNT OF MONEY AT RISK. PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT INDICATIVE OF FUTURE RESULTS.

Risk Disclosure for Genie Results, T.03, T.03+ and TradeProgram: HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.